‘Soft’ spot rates another signal of freight-economy trouble?

The spot market for freight has been “iffy” or “recovering” for much of the time between the second half of 2022 into this year, according to various analysts. But these days, the latest catchphrases for the market critical to smaller fleets and owner-operators are “soft” or "bottoming," according to the latest from the research firms that analyze trends in the marketplace, two of which also run load boards.

Data for the week of March 24 from Truckstop, which runs a leading load board, and FTR Transportation Intelligence, a trucking industry researcher, characterize the spot market as “soft,” especially in two critical segments of freight-hauling: dry van and refrigerated (reefer).

See also: Months into port labor talks, shippers fear more supply chain ramifications

Broker-posted spot rates for both segments were down week-over-week, as was the load volume on the spot market, according to Spot Markets Insights, released weekly and jointly by Truckstop and FTR.

The two companies sounded cautious about the spot market, saying it “is in the early days of a period of softness—at least in the van segments—that typically runs until the Commercial Vehicle Safety Alliance International Roadcheck inspection event in mid-May. Further minor decreases in rates or volume would not necessarily indicate that the spot market is undergoing anything more significant than seasonal weakness.”

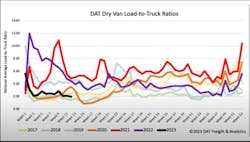

However, in a separate emailed market update by DAT iQ and DAT Freight & Analytics, which runs load board DAT One, Ken Adamo, DAT’s chief of analytics, raised the prospect of national linehaul rates (which do not include fuel) dipping below $1.45 per mile (they sit around $1.70 now) by late April.

“Instinctively, I want to believe that produce season and retail shopping in the spring will elevate rates. Our Ratecast models are becoming less and less optimistic,” Adamo said in the mid-March update. “I will tell you if anything close to (our short-term rate forecast) materializes, we’re going to be looking at some significant negative impacts on capacity.”

Spot rates setting not-so-great milestones

The linehaul rate of around $1.70 already is a three-year low going back to March 2020, Dean Croke, DAT’s principal analyst, said during the data-aggregating firm’s weekly video presentation, DAT iQ Live, on March 28. Croke said dry van spot rates are down 70% compared to this time last year.

During the video, he also said that some closely watched freight lanes, such as Los Angeles to Stockton, California, which is the “busiest spot market lane on the West Coast,” are experiencing a slump, though weather in the region gave them a small recent bump. In the L.A.-to-Stockton lane specifically, he said, the spot rate of $2.49 per mile is the lowest in a year and that volumes there were down 2% last week. In another busy lane out West, L.A. to Phoenix, rates are the lowest in 12 months and 45% lower year-over-year, Croke said.

See also: Diesel slide reaches two-month mark

Participants in the DAT iQ Live, presumably some who are smaller carriers and owner-operators, decried the “soft” spot rates. One, Orlando Landois, said, “NO!! to cheap freight,” while another, Murvin Johnson, said, “the little guys [are] feeling it.” A third, Jacob Flint, reported a North Carolina-to-Florida route was paying “less than $2 per mile.” Johnson added: “I am just running for the fuel.”

Matters are incrementally better in freight and rates in the contract market, which is mostly used by larger trucking companies, while the spot market is utilized for the most part by smaller trucking companies and owner-operators, though there is some crossover by bigger freight haulers.

Last week, American Trucking Associations reported that its seasonally adjusted For-Hire Truck Tonnage Index has increased sequentially for the last three months, an indicator that contract freight continues to hold up at high levels, ATA Chief Economist Bob Costello said.

“Tonnage has increased sequentially for the last three months totaling 2.9%,” he said. “As a result, the index is just 0.3% below the recent high in September.”

“Looking ahead, we continue to see evidence the inventory cycle is improving, which means bloated stocks will stop being a headwind and eventually help truck freight volumes,” Costello added. “Increased infrastructure spending will also boost volumes heading into the summer months. However, we expect to see continued freight softness related to lower home construction and slowing factory output.”

However, during the DAT video, Croke referenced demand indices, including ATA’s tonnage index, and noted that active contract rates for repetitive lanes in routing guides are down 1% for dry van and that replacement contract rates based on past RFPs are down 9% in the last two weeks.

ACT report voices more pessimism

In its March 27 release, ACT Research, another trucking data-analysis company, said its For-Hire Trucking Index is seeing a sharp slowdown in capacity growth.

Freight volumes and rates declined in February, according to ACT, “but we’re closer to the end than the start of this freight downcycle,” adding that “rate trends should begin to recover as soon as traction on freight volumes is established, and slower capacity growth … is a hopeful sign the bottoming process is closer, as fleets begin to respond to softer market conditions.”

ACT also reported that its Trucking Volume Index in February “was in contraction territory” for the eighth of the past 11 months and that “volumes remained soft amidst a market of mixed economic signals.” A separate ACT measure, its Capacity Index, also declined for the month, indicating slower growth, ACT said.

Tim Denoyer, VP and senior analyst at ACT, noted, “The soft freight market persists as inflation continues to impact consumers’ purchasing power, and recent bank failures and job cuts make recession more likely.”

“The cure for low prices is low prices, and we currently estimate spot rates are 16% below fleet operating costs, which should expedite this bottoming process," Denoyer added. "Even as freight demand fundamentals will likely remain soft, seasonal increases in [truckload] volumes as capacity slows and eventually tightens will build the bottom of the spot-rate cycle in the next couple of months.”

About the Author

Scott Achelpohl

Managing Editor

Scott Achelpohl is a former FleetOwner managing editor who wrote for the publication from 2021 to 2023. Since 2023, he has served as managing editor of Endeavor Business Media's Smart Industry, a FleetOwner affiliate.