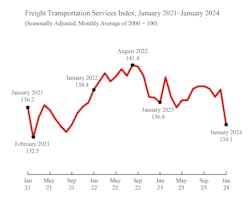

Adjusted for-hire truck tonnage and overall freight tonnage were both down year-over-year in January, according to the latest Freight Transportation Services Index (TSI) from the U.S. DOT’s Bureau of Transportation Statistics.

According to the BTS report, the overall freight index was 134.1: down 3.1% from December 2023. Compared to January 2023, the January 2024 index fell 2%. This latest index is the lowest score since September 2021.

The index’s January’s month-over-month decrease was the largest drop since April 2020, near the beginning of the COVID-19 pandemic. The January score was 5.2% below DOT’s greatest recorded peak in August 2022 (141.4).

See also: Maintenance labor costs on the rise while parts costs stabilize

BTS’s Truck Tonnage Index, which measures seasonally adjusted truck tonnage, was also down month-over-month and year-over-year. With the index at 110.5 this January, truck tonnage fell 4.2% from December and 4.9% from last year's January. This is the Truck Tonnage Index’s lowest score since May 2020.

The low index score for January came amid mixed numbers from other major economic indicators. According to DOT, the Federal Reserve Board Industrial Production (IP) Index declined by 0.1% in January, reflecting decreases of 2.3% in mining and 0.5% in manufacturing, while utilities grew by 6%. Housing starts were down 14.8%, while personal income increased by 1%.

A mixed start to 2024

Other freight market reports suggested a positive turn for fleets in 2024.

ACT Research and FTR found significant increases for Class 8 vehicle orders in January—a 35-45% year-over-year increase. The research firms also forecasted a rise in production and sales of Class 8 vehicles in February.

DAT Freight & Analytics recorded all-time highs for spot freight volumes in January, according to its Truckload Volume Index. Freight volumes for van, refrigerated, and flatbed trucks were all up 11-14% month-over-month and 1-6% year-over-year. DAT's measured load-to-truck ratios also increased in January.

For February, the Cass Freight Index found shrinking declines in shipment volumes and freight expenditures. While still down year-over-year, February saw the index’s smallest year-over-year decline in 10 months.

An analyst at FTR told FleetOwner that 2024 could be the start of a slow recovery for U.S. trucking.

"Our forecast is that it’s not going to get any better for shippers and probably not any worse for trucking companies,” Avery Vise FTR’s VP of trucking, said. “We see sort of a prolonged kind of strengthening of the market.”

About DOT's Freight Transportation Index

The Freight TSI records the amount of freight carried by the for-hire transportation industry. The index is a weighted average of monthly data for trucking, freight rail, waterborne, pipeline, and air freight.

The index reflects the output of for-hire freight transportation, seasonally adjusted for better month-to-month comparisons. The index does not include international or coastal waterborne movements, private trucking, courier services, or the U.S. Postal Service.

DOT plans to release the February 2024 on April 10.

About the Author

Jeremy Wolfe

Editor

Editor Jeremy Wolfe joined the FleetOwner team in February 2024. He graduated from the University of Wisconsin-Stevens Point with majors in English and Philosophy. He previously served as Editor for Endeavor Business Media's Water Group publications.