Sales of both new and used Class 8 trucks continue to trend down compared to the previous month’s orders and sales, according to recent reports.

Preliminary April data from ACT Research and FTR Transportation Intelligence found Class 8 orders fell according to seasonal trends but increased compared to last year.

Data from ACT on used-vehicle sales for March found a decline in both units and prices compared to the previous month, but those used units and prices also declined from last year.

See also: Diesel drops to lowest price since January

Class 8 orders down from March, up from last year

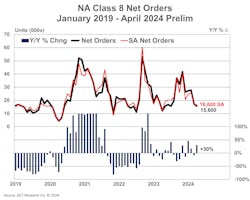

ACT’s preliminary count of Class 8 net orders for April in North America was 15,600 units. The count is down 1,800 units from March but 30% higher than April 2023.

FTR’s preliminary count of Class 8 net orders for April was 14,000 units. This compared similarly to ACT’s on a month-by-month and year-by-year basis: April’s orders were down 28% from March but 12.5% higher than last year.

The number of orders placed by both firms in April was significantly lower than those placed in January, February, and March. However, historically, second-quarter orders tend to decline from Q1.

“Even in good years, Q2 typically delivers below-trend orders, while Q4 orders can trigger optimism at the bottom of the cycle,” Kenny Vieth, president and senior analyst at ACT, stated in a release. “Entering the historically worst time of the year for orders, at the bottom of on-highway tractor buyers’ profitability cycle, is producing results in line with expectations.”

See also: Baltimore bridge collapse: Fleet challenges, recovery efforts progress

According to FTR's senior analyst Dan Moyer, the April counts were within seasonal expectations.

“Despite the month-over-month decline, the fact that orders were up from the April 2023 level indicates that the market is still solid,” Moyer said in FTR’s April orders report. “Order levels were below the historical average but remain in line with seasonal trends, and we still expect a replacement level of output by the end of 2024.”

Used Class 8 prices, sales declined in March

The market for used Class 8 vehicles in March cooled down month over month and year over year.

ACT’s latest State of the Industry: U.S. Classes 3-8 Used Trucks found drops in units sold and average prices for used Class 8 trucks in March.

The average retail sale price in March fell to $60,100, down 2.9% from February and down 20% year over year. Units sold also fell 6% from February and 4% from last year.

According to ACT, the average mileage and age of used equipment had also decreased both month over month and year over year. The firm’s average miles per used Class 8 vehicle fell 1% from February and 4% from last year. In addition, the average age declined 7% month over month and 4% year over year.

About the Author

Jeremy Wolfe

Editor

Editor Jeremy Wolfe joined the FleetOwner team in February 2024. He graduated from the University of Wisconsin-Stevens Point with majors in English and Philosophy. He previously served as Editor for Endeavor Business Media's Water Group publications.