Spot load posts fall 4.6% as holiday freight disappoints

The number of available loads on the spot truckload freight market fell 4.6% during the week ending Dec. 15, running counter to the typical seasonal bump in demand for trucks, according to DAT Solutions, which operates the DAT network of load boards.

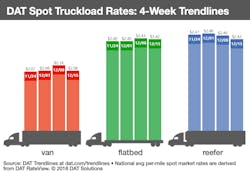

National average load-to-truck ratios — a measure of demand for available truckload capacity — dipped for vans and flatbeds, while spot rates declined for all three equipment types:

- Van: $2.08/mile, erasing a 6-cent gain from the previous week

- Flatbed: $2.42/mile, down 1 cent

- Reefer: $2.42/mile, down 4 cents

Van trends: The national average van rate was $2.08/mile last week. Spot van rates may be slipping but the linehaul or “demand” component has strengthened in recent weeks, indicating the influence of falling fuel prices on current rates. The average price of on-highway diesel was $3.12/gallon on Dec. 17, a 4-cent decline compared to the previous week.

Outbound spot van rates were softer in major markets, including Chicago ($2.51/mile, down 5 cents); Columbus, OH ($2.50/mile, down 3 cents); Los Angeles ($2.55/mile, down 13 cents); Memphis ($2.29/mile, down 7 cents); and Buffalo ($2.56/mile, down 10 cents). The absence of demand in the Northeast is an indication that shippers increased their use of intermodal and contract carriers for holiday freight.

Flatbed trends: After a 103% increase the previous week, the number of flatbed load posts were down 4% while truck posts slipped 3%. As a result, the national flatbed load-to-truck ratio dipped from 19.8 to 19.6 loads per truck.

Reefer trends: Reefer load posts were virtually unchanged following a 46% increase in load posts the previous week. The number of truck posts also remained the same, as did the national load-to-truck ratio at 6.3 reefer loads per truck.

Demand for fresh produce remains strong even though most fall crops have already been harvested in the U.S. and spring is still a few months away. A larger proportion of fresh fruit and vegetables are being imported from Mexico through a handful of border crossings in California, Arizona, New Mexico, and Texas. Notably, the average from McAllen, Texas, to Dallas was up 7 cents to $2.84/mile.

Elsewhere, rates on regional reefer lanes were unspectacular but solid:

- Green Bay to Wilmington, Ill.: $3.67/mile, up 12 cents

- Atlanta to Lakeland, Fla.: $3.34/mile, down 1 cent

- Ontario, Calif. to Phoenix: $3.68/mile, down 5 cents

DAT Trendlines are generated using DAT RateView, which provides real-time reports on spot market and contract rates, as well as historical rate and capacity trends. The RateView database is comprised of more than $57 billion in freight payments.

DAT load boards average 1 million load posts per business day.

About the Author

Fleet Owner Staff

Our Editorial Team

Kevin Jones, Editorial Director, Commercial Vehicle Group

Cristina Commendatore, Executive Editor

Scott Achelpohl, Managing Editor

Josh Fisher, Senior Editor

Catharine Conway, Digital Editor

Eric Van Egeren, Art Director