Key takeaways:

- FTR predicts a tariff rate increase of 21% in 2025, though consumers and businesses aren’t likely to see 21% price hikes on goods as companies should “absorb” some of the cost of tariffs.

- Tariffs have caused out-of-the-ordinary market activity, such as pulling forward on inventory without amping up production and automotive and trucking equipment prebuy.

- While Q1 2025 experienced an uptick in market activity, FTR predicts the market will slow just as quickly as we head into the remainder of 2025.

While businesses are facing uncertainty as the middle of the year approaches, FTR Transportation Intelligence analysts are certain that tariffs are going to curtail economic growth into 2026.

FTR shared its latest forecast during a webinar centered around how the transportation economy has shifted since President Donald Trump was elected last November. The firm’s spring 2025 forecast includes predicted effects from the widespread tariffs that the Trump Administration has put on global U.S. trading partners.

“How did the tariffs affect our forecast?” Avery Vise, VP of trucking at FTR, asked during the presentation. “First of all, we have to start with the tariff rate.”

Tariffs and the economy

FTR predicts a tariff rate increase of 21% in 2025, compared to its previous projection of 2% back in November. While Vise admits the tariff rate could be higher than that, he states that “we're allowing for a little bit of leeway there for, [trade] deals, exceptions, and so forth."

See also: Warning: Severe tariff consequences approaching

The effects of these tariffs will increase inflation, FTR predicts, though consumers and businesses aren’t likely to see 21% price hikes on goods as companies “are going to absorb some level of those tariffs,” Vise explained.

Overall, FTR assumes inflation will rise sharply and peak at 4% annualized before easing gradually, he said.

Other aspects of the economy that Vise predicts the tariffs will impact include Federal interest rates, which he predicts could be cut twice rather than the previously predicted four times, and the unemployment rate, which currently stands at 4.2% but is predicted by FTR to rise by 5% because of the “stressors” brought on by tariffs.

Economic distortions due to uncertainties

The tariffs have also brought along economic activity that’s out of the ordinary, which FTR calls “distortions.” One such distortion is the excess imports experienced in March.

“Businesses want to bring forward inventories so that they don't have to pay tariffs on those,” Vise explained. “We have seen just an unfathomable surge in total imports.”

Imports in March were up 20% year over year, Vise said.

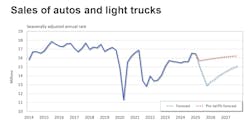

Another distortion was in vehicle sales, with consumers rushing to purchase both foreign-made and domestically assembled vehicles that will soon be affected by tariffs.

March vehicle sales were the highest FTR has seen since spring 2021.

“We don't have official data yet for April, but most estimates put the April sales at fairly similar levels,” Vise said.

Two factors, however, will cause a steep decline in vehicle sales, according to Vise: “Soon, we're going to get to the point where the vehicles on the lots are going to be more expensive, but also, we've essentially had a prebuy,” he explained, referring to future dealer vehicle inventories being affected by tariffs and consumers’ rush to purchase vehicles in March and April.

See also: Tariffs torpedoed Knight-Swift hopes for a seasonal rebound in March

Another distortion brought on by tariffs related to the automotive industry is that its production isn’t keeping pace with automotive sales. Vise contends that this is to be expected, due to the surge in demand caused by tariffs and not organic growth, but he asks what the implications are for automakers moving forward.

“Do [automakers] live with leaner inventories on dealer lots with the expectation that higher prices are going to keep [customers] away as well as the prebuy, or do we see an increase in production because [inventory] becomes uncomfortably low?” Vise said. “My guess is it's more likely to be the former, but it is one of the uncertainties that we're certainly dealing with.”

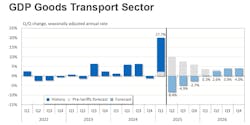

Not only was there an increase in automotive sales in Q1 2025 but also an annualized increase in trucking equipment sales by nearly 23% quarter over quarter.

“This also is almost certainly a prebuy effect due to tariffs,” Vise explained. “We just would not anticipate any kind of organic increase to that degree.”

Expect swift payback

Just as quickly as the market ramped up to offset the effects of tariffs, FTR expects a payback in multiple market segments. Transportation was busy during the first quarter of the year, as the gross domestic product goods transport sector increased 17.7% quarter over quarter—the “largest since Q3 2020,” Vise said, but the payback for those gains is coming.

Vise predicts that the volume of goods shipped from Asia will continue to decline through the end of the year and into 2026.

“Suffice it to say that we're looking at almost a uniformly negative environment in tariffs relative to where we would have been prior to the tariff imposition,” he concluded.

About the Author

Jade Brasher

Senior Editor Jade Brasher has covered vocational trucking and fleets since 2018. A graduate of The University of Alabama with a degree in journalism, Jade enjoys telling stories about the people behind the wheel and the intricate processes of the ever-evolving trucking industry.