Freight demand softens after July 4 rush

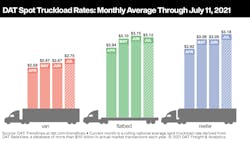

According to DAT Freight & Analytics (DAT), the weeks leading up to Independence Day typically mark an annual peak in spot truckload freight volume and rates following a rush to move goods ahead of the close of June and the July 4 holiday. While last year was an exception, 2021 is starting to follow a more typical pattern albeit at elevated levels: Spot rates for van, refrigerated and flatbed freight are on average 70 cents per mile higher than at this time in 2020 and nearly 76 cents higher than the five-year post-July 4 average.

The number of available dry van loads on the spot market was down 17% during the week ending July 11, in line with expectations given the holiday-shortened workweek, said DAT.

Van equipment posts also declined as truckers took time off for the holiday. The national average van load-to-truck ratio narrowed from 6.7 to 6.1 and the national monthly average van rate through July 11 was $2.75 per mile, 8 cents higher than June. Contract van rates are on the rise, with new routing-guide rates up 7% in the two weeks ending July 1 compared to the prior two-week period. The average contract van rate is now 37 cents higher than this time last year.

The national average spot reefer rate through July 11 was $3.18 per mile, 9 cents higher than the June average. The number of available reefer loads fell 17% compared to the previous week and, with 2% fewer equipment posts, the national average reefer load-to-truck ratio edged down from 14.2 to 12.7. Demand for trucks is expected to ease in the coming months: between July 4 and Thanksgiving, weekly truckload volumes of produce typically decline an average of 21%, which translates to carriers hauling 7,300 fewer truckloads per week by the end of November.

With fewer load and equipment posts last week, the national average flatbed load-to-truck ratio fell from 49.7 to 44.1. The average spot flatbed rate slipped to $3.12 a mile through July 11, down from $3.15 in June.

Lanes to watch:

- The average reefer rate from Atlanta to Chicago, a 716-mile run, has nearly doubled in the last year and is $1.70 a mile higher than the contract rate, which is highly unusual and partly reflective of weak pricing in the opposite direction.

- Rates from Los Angeles to Las Vegas held steady at an average of $6.12 a mile last week but the return leg jumped 25 cents to $5.23. That’s an average of $5.40 a mile for the 540-mile round trip.

- The average van rate from Atlanta to Philadelphia surged last week, increasing by 55 cents to $4.23 a mile. That’s up $1.86 since January. Rates in the opposite direction are down an average of 52 cents during the same period.