West Coast port markets driving spot truckload freight volumes

The number of available loads on the spot truckload freight market rose 0.3% during the week ending August 1, according to DAT Freight & Analytics. The number of available trucks fell 1.2% compared to the previous week.

Truckload rates on the spot market typically drop after the July 4 holiday but were elevated all month, buoyed by demand in southern California and other port markets. July volumes declined compared to June, the busiest month on record: the number of available van, refrigerated, and flatbed loads on the DAT network fell 17.1%, and capacity dropped 6.6%.

Trendlines

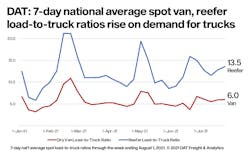

Dry van load-post volumes increased slightly. Equipment posts remained flat last week, and the national average van load-to-truck ratio was virtually unchanged at 6.0. The average van rate was $2.73 per mile, matching the average for July. In DAT’s top 100 van freight markets by volume, the number of loads moved increased 2.5% last week.

West Coast port markets are driving demand for truckload services. Ships continue to bunch up outside Long Beach and Los Angeles ports, where about one-third of all container imports arrive. The average outbound van rate from Los Angeles was $3.70 per mile last week. Los Angeles to Phoenix, a key lane for imported e-commerce freight, hit $4.61 a mile.

Los Angeles to Chicago averaged $3.13 per mile for spot van freight and the number of loads moved soared 39.9% in the last four weeks. The ongoing chassis trailer shortage has been exacerbated by higher-than-normal container dwell times for local container delivery and intermodal rail cars to move containers east. All of this contributes to higher spot market truckload volumes off the West Coast as shippers struggle with reduced intermodal capacity on freight lanes to congested inland destinations.

The number of reefer loads rose 4% last week, while truck posts declined 1%. The national average reefer load-to-truck ratio inched up from 12.8 to 13.5 last week and the national average spot reefer rate rose 1.7% to an average of $3.15 per mile (rates include a fuel surcharge).

The national average spot flatbed rate held at $3.00 per mile last week, 11 cents less than the July average. Flatbed load-post volumes fell 2% week over week and are now down 4% over the last month. Capacity tightened with an 8% decrease in equipment posts compared to the previous week, which pushed the flatbed load-to-truck ratio higher from 44.6 to 47.4.