Numbers tell story of strained supply chain—but also of opportunities for trucking

The numbers don’t lie, especially where the strained supply chain is seen clashing with higher-than-ever ecommerce demand—all in the midst of the disruptive COVID-19 pandemic.

One statistic: An average of 96 container vessels are sitting offshore, with an average wait time to dock and unload of 21 days, at the Ports of Los Angeles and Long Beach in California, which handle 40% of the nation’s shipping container traffic. That’s five times the number of containerships in the waters off L.A./Long Beach than at this time last year.

Another: Volumes are up 155% year-over-year along perhaps the nation’s largest inland intermodal route between L.A. and Chicago.

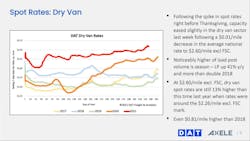

Still another: Spot rates in dry van and reefer markets are at record levels—up 13%.

Yet another: Total truckload capacity is up 5.4% year-over-year, with capacity up among owner-operators a staggering 28%.

See also: Waiting for the dam to burst: Pent-up demand held back by supply chain

One more: Contract rates are up 11% year-over-year.

“We’re seeing extraordinary year-over-year volumes. The port crisis is bringing carriers opportunities,” said Dean Croke, principal analyst at DAT Freight & Analytics, who did note evidence over the last three months that capacity is slowing or is being added at a slower rate compared to earlier this year.

Croke was one of three analysts who chimed in during a webinar, “Supply Chain Challenges and Opportunities for Carriers in 2022,” on Dec. 9 hosted by Axele, a transportation management system company. The other panelists were Scott Anderson, another DAT transportation expert, and Stephen Jordan, an Axele business development executive.

"West Coast port congestion won't ease until 2022," Croke predicted based on the data.

See also: The supply chain’s ‘velocity problem’

Another panel of experts reported similar strain in Pacific Northwest freight transportation at a Dec. 7 Oregon Trucking Association (OTA) media roundtable, “Supply Chain Challenges and Trucking’s Role.” Participants during that roundtable were Jana Jarvis, OTA’s president and CEO, Mike Card, president of Oregon-based Combined Transport and former chairman of American Trucking Associations (ATA), and representatives from FedEx Corp. and the Port of Portland, Oregon.

The impact of the driver shortage a source of some debate

There was some debate among two webinar participants regarding the present impact on the supply chain of the truck driver shortage, which ATA estimates to now be around 80,000 drivers and possibly headed to 160,000 by the end of the decade if trucker roles don’t increase.

“A lot of folks are making a big deal about the driver shortage. We could have just enough trucks to move the freight, but trucks aren’t moving through the network fast enough,” Croke said of the current supply chain crunch.

Card, during the OTA media roundtable, stressed, “There’s a real shortage of truck drivers. Trailers are sitting because of a lack of drivers.” He said long-haul trucking alone is down 5.9% in drivers.

Jarvis added, however: “The driver shortage is not the only piece of the supply chain issue.”

The severity of the driver shortage—and its impact on the supply chain—has come under much scrutiny lately. There is also disagreement about what is causing the trucker shortage.

The public is paying more attention to the supply chain, largely because of the highly publicized backups at U.S. ports and delays in some goods getting to their front doors. And the attention has spread to issues that are causing the freight transportation network to clog. The driver shortage is one, but among the others are staff shortages at freight terminals and warehouses caused in part by the pandemic, the backups at the ports, a lack of chassis for drayage transport, and longer dwell times at terminals all over the country, not just at the ports.

The whole supply chain has a “velocity problem,” David Arsenault, president of GSC Logistics Inc. and participant in another webinar last month.

“Having been in the supply chain for 35-plus years, [it’s] been out of sight, out of mind until the pandemic,” added Glenn Jones, global VP of product strategy and marketing for Blume Global, who also joined that November webchat. Since COVID-19’s onset in 2019, the chain has gone from “the boardroom to the living room” in the amount of attention that it’s received, he said.

About the Author

Scott Achelpohl

Managing Editor

Scott Achelpohl is a former FleetOwner managing editor who wrote for the publication from 2021 to 2023. Since 2023, he has served as managing editor of Endeavor Business Media's Smart Industry, a FleetOwner affiliate.