U.S.-based supply chains are out of sync, according to the 2022 State of Logistics Report, which notes that freight movement here is adjusting to short-term changes and perhaps uncovering long-term solutions.

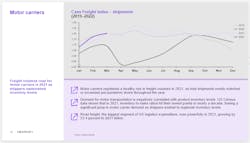

Just as U.S. motor carrier demand spiked in 2021, trucking capacity saw several disruptions as global supply systems halted and restarted: consumer demand surged from COVID-19 pandemic-related stimulus payments; carriers who reduced headcount and equipment in early pandemic days were left scrambling to keep up with consumers.

“It’s not surprising that we are continuing to see ongoing disruptions related to the pandemic, but the scope and impact of disruptions continue to weigh heavily on the minds of logistics providers—as they do for all companies contributing to the U.S. economy,” explained Balika Sonthalia, the report’s lead author and partner at consulting firm Kearney.

See also: Fleets, suppliers must prepare as shortages continue

These are among the findings in the State of Logistics Report produced by Kearney for the Council of Supply Chain Management Professionals (CSCMP) and presented by Penske Logistics. The group unveiled the 33rd annual report at the National Press Club in Washington, D.C., on June 21.

“We have seen an incredible amount of resiliency among private truck fleets and dedicated contract carriage truck fleets,” Andy Moses, SVP of sales and solutions at Penske Logistics, pointed out. “Demand has been up sharply year-over-year, and these fleets continue to manage the complexities they face in the trucking supply chain, including headwinds caused by shortages of parts, equipment, drivers, and most recently rising fuel costs.”

The publication offers a snapshot of the American economy through the lens of the logistics sector and its role in supply chains. The report is a compilation of leading logistics intelligence from around the world. It spotlights industry trends and insights on evolving supply chains across several sectors.

Trucking’s inflation role

Looking ahead, CSCMP does not see trucking’s workforce shortfalls ending soon, which will play a role in inflation in 2022. The report's authors found that strong demand for trucking freight combined with constrained carrier capacity drove up contracted and spot rates in 2021.

The rising fuel costs of 2022 are adding to the inflationary effects, according to CSCMP. Shippers are passing increased transportation costs to consumers. J.M. Smucker Co.—whose brands include Jif peanut butter, Folger’s coffee, Milk-Bone dog treats, and Shmucker’s jelly—blamed rising transportation and commodity costs for its decreased profits in 2021.

While the spot market shows signs of softening, contracted rates could be locked in at high levels after a successful year for larger carriers. Some of the large carriers saw massive profits in 2021, CSCMP found. It cited Old Dominion Freight Line (54% more gains in 2021 compared to 2020), Schneider (100% profit increase), and Hub Group (up 73%).

Reshoring manufacturing could benefit trucking

The U.S. logistics sector is already adapting to the new supply chain, according to Sonthalia, the report’s lead author. She said these changes should benefit manufacturers, retailers, and consumers.

With maritime freight having its own struggles this year, more companies are looking at reshoring and nearshoring, which could create more opportunities for North American trucking networks, according to the logistics report. A 2021 Kearney survey of U.S. manufacturing executives found that 41% had reshored at least a portion of their operations since 2019; another 22% said their company plans to reshore some manufacturing within the next three years.

“Reshoring and nearshoring will create strong demand for new north-south flows in addition to established east-west routes, while new regional networks will emerge,” the authors wrote. “Additionally, carriers can offer new services to efficiently facilitate cross-border movement of goods, while also developing partnerships with carriers based in Mexico.”

More shippers look to create private fleets

For-hire carriers that fail to increase their service levels could lead more shippers and companies to create or build up private fleets, which provide those companies with control of their freight.

“The shipper community has a collective sense that control has been slipping away. The old notion that you can buy the capacity as we need it—and turn the tap on or off—is a thing of the past,” Gary Petty, president of the National Private Truck Council, told FleetOwner earlier this year.

See also: Fleet leaders see more AI technology in their immediate futures

CSCMP found that the cost of creating and maintaining a private fleet “has shrunk substantially, while the advantage of controlling capacity and assuring services became increasingly compelling for many shippers.” The logistics report saw more shippers’ turning to private fleets.

“The private fleet is still peaking,” Petty said. “It’s never had more attention, visibility, and importance in the shipper community than today. That is driven by so much uncertainty going on—if the capacity is not under control and managed internally, there’s risk that it won’t be there.”

Investing in drivers could be essential to profits

CSCMP said one of the keys for carriers is centered on drivers. “Given the recent rise in both freight volumes and shipping rates, motor carriers should invest more proactively in recruiting, training, and compensating drivers,” the report authors wrote. “As those efforts take hold, they can move to retain drivers by offering more flexible scheduling, larger appointment-time windows, better driver facilities along long-haul routes, and quicker payment terms.”

Key findings on U.S. supply chain

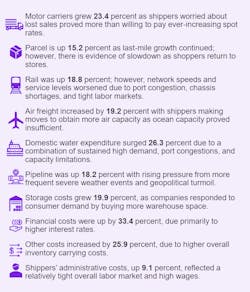

A key statistic the report generates is the U.S. business logistics costs, which in 2021 was up by 22.4% to $1.85 trillion, representing 8% of 2021’s $23 trillion GDP. Here are some other findings of interest from the report:

- Business inventories dropped to near-historic lows, but the costs associated with storing, handling, and financing these items rose considerably.

- Inventory-carrying costs rose by 25.9% in 2021, and transportation costs jumped 21.7%. This led to uneven supply chains and inconsistent product availability for consumers (both in-person and online).

- Efforts to increase multi-shoring are expected to accelerate. Companies are seeking to have operations move closer to the U.S., to respond quickly to fluctuating market demands.

- Last year’s report noted the effects of the pandemic on the supply chain. The residual challenges of the pandemic remain, with some disruptions continuing to deliver damaging effects on capacity.

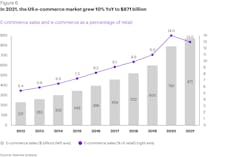

- Last-mile delivery volume is trending upward. The 2022 report notes that ecommerce sales grew 10% last year (to $871 billion), accounting for 14% of U.S. retail sales.

- Trucking freight continues to see more volume and opportunities. With road freight accounting for the largest segment of the U.S. supply chain spend, it expanded by 23.4% to a lofty $831 billion.

About the Author

Josh Fisher

Editor-in-Chief

Editor-in-Chief Josh Fisher has been with FleetOwner since 2017. He covers everything from modern fleet management to operational efficiency, artificial intelligence, autonomous trucking, alternative fuels and powertrains, regulations, and emerging transportation technology. Based in Maryland, he writes the Lane Shift Ahead column about the changing North American transportation landscape.