Key takeaways

- The trucking industry has seen a 30% increase in CDL holders since 2016, with driver pay rising over 20% adjusted for inflation.

- Debates persist over whether there is a driver shortage or an excess. Some point to capacity constraints due to high turnover and recruitment challenges.

- Private fleets are expanding their driver bases by offering higher salaries, which complicates capacity reduction efforts and intensifies labor competition with for-hire carriers.

Excess capacity has helped weaken carriers’ pricing power for years. Despite this hostile environment, the CDL population is growing: the American Transportation Research Institute estimates that there are about 3 million long-haul CDL holders today, up 30% from 2016’s estimate of 2.3 million.

While the driver shortage has remained one of the top fleet concerns for several years, not everyone agrees with the concept of a labor shortage in trucking. In a recent Stifel webinar, analysts with Transportation and Logistics Advisors argued that the market is plagued with too many drivers.

“It’s really all about drivers,” Steven Fox, principal of Transportation and Logistics Advisors, said during the webinar. “Drivers are the key to what’s going on in the trucking market and capacity.”

On the other hand, a recent Tech.co survey argued that carriers don’t have enough qualified drivers. So who’s right?

Too many drivers?

An excessive driver population could be the prime reason for excess capacity, suggested Fox.

“Some data that people talk about a lot of times, as a way to get a handle on capacity, are things like the number of carrier bankruptcies, number of trucks, and new truck orders,” Fox said. Those metrics give a general sense of the market, he said, “but it doesn’t really tell you much about trucking capacity.”

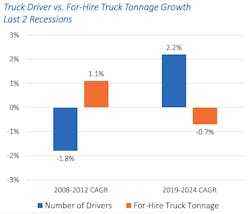

To illustrate his point, Fox compared driver populations during the Great Recession and recovery (2008-2012) versus the current economic environment (2019-2024). For-hire tonnage grew, while the number of drivers shrank in the recession period. In the current period, the dynamics reversed: Drivers grew 2.2%, while tonnage shrank 0.7%.

During the five-year period, not only did the number of drivers increase, but their pay spiked dramatically as well, rising over 20% after adjusting for inflation. The American Trucking Associations found that the average truck driver's salary in 2023 was $76,420, according to its most recent compensation survey covering over 160,000 drivers.

With the increase in pay, Fox suggested drivers are more inclined to continue making truckload hauls, maintaining the sector’s persistent overcapacity.

“Why would anyone leave this? Why would they quit?” Fox asked rhetorically. “Drivers are staying in this market despite the fact that the freight is down and that even the trucking rates are down significantly from where they were.”

The rise of private fleets

The issue is compounded by private fleet growth. For several years, private fleets have been growing their driver base, which impedes what might have been a more natural capacity reduction.

But if the issue is that drivers are paid too well to leave, why aren’t for-hire fleets with poor margins just reducing pay or laying off drivers? Private fleets, again, complicate the problem by competing with for-hire carriers for labor.

In ATA’s 2024 compensation survey, the average driver salary increased 10% since 2021. Private fleet drivers’ average salaries, on the other hand, increased 12% since 2021 to $95,114 in 2023.

“A private fleet doesn’t have any drivers and needs to get them. They don’t have a recruiting network, so they just throw money at it,” Lee Clair, a managing partner for Transportation & Logistics Providers, said during the webinar. “Typically, the private fleets are tied to the benefit program of the parent company, which is typically richer than a truck line has … If a truck line tries to downsize and cut pay, there’s a good chance their driver base is just going to leave.”

In a white paper on the topic, Transportation and Logistics Advisors predicts that trucking overcapacity will still stabilize by reducing overall driver counts. The firm expects logistics preferences to again shift from private to for-hire fleets, older driver retirements to shrink the labor market, and economic growth to lure drivers into more traditional blue-collar work.

Not enough drivers?

Trucking’s labor problems are never without disagreements. Tech.co’s “Moving Goods with Fewer Hands” report, based on a survey of 521 logistics professionals, concluded that freight demand was abundant, and the real problem was a driver shortage.

The report’s authors claimed that a strong majority of surveyed logistics businesses were operating near capacity because 85% of respondents said that their businesses were operating at or above 75% capacity.

The definition of “capacity” and whether 75% is “near capacity,” however, is unclear. Truck utilization as a metric for operational capacity, for example, generally remains above 90% nationally. FTR Transportation Intelligence, in its latest Key Issues in Transportation webinar, described its forecasted truck utilization rate above 92% as “low” and “an underwhelming recovery.” It was also not clear which segments the survey respondents represented.

But the Tech.co survey’s perception of a driver shortage was clear: 69% of respondents said a driver shortage had an impact on their ability to meet freight demand. Nearly the same number of respondents, 63%, said that their ability to recruit and retain drivers either stagnated or worsened over the past year.

Respondents not too concerned about turnover

When asked about the biggest challenges in maintaining a steady driver workforce, the greatest number of respondents (45%) cited “lack of qualified applicants.” About 34% cited “competition from other employers,” and only 31% cited “high turnover.”

Though a minority of respondents cited turnover, other reports find that it is still a major issue for maintaining a steady workforce. ATRI estimated that overall industry turnover was 48% in 2024, and many fleets face a turnover rate over 90%. The average turnover for blue-collar roles in the U.S. overall is much lower at about 15%. With the majority of respondents reporting weaker retention, that turnover problem could get worse.

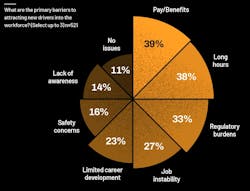

Respondents also identified what they thought were the largest barriers to attracting new drivers to the workforce: pay/benefits (39%), long hours (38%), regulatory burdens (33%), job instability (27%), and limited career development (23%).

Most respondents (56%) said that they are focusing on work-life balance and driver compensation to improve staffing.

Regardless, the driver population is changing

Overcapacity or not, the only constant in trucking is change. According ATRI’s latest report on truck driver demographics, the driver population is growing older and more racially diverse.

The report used historical survey data, government datasets, state driver’s license data, and a recent ATRI survey of 1,242 drivers.

Drivers are aging

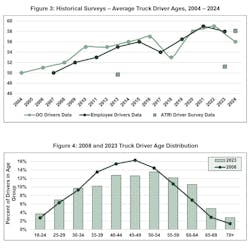

America’s trucking workforce is still getting older. ATRI’s most recent driver survey found an average driver age of 58 years old—a sharp increase from about 51 years in ATRI’s 2023 survey and 50 in 2013.

Employer surveys from ATRI and surveys from the Owner-Operator Independent Drivers Association Foundation find a similar trend: Average driver age has ramped up over the last decade. Government census data finds a much lower average age than ATRI or OOIDAF surveys—about 47 years old—but is still notably older than in 2008, when census data found drivers were an average 45 years old. The census data’s overall distribution of truck driver ages also skewed older in the last 15 years.

ATRI blamed the aging workforce partly on interstate CMV age requirements and pressure from insurers.

Classification: More drivers for smaller fleets

Among the major truck driver classifications (employee drivers, owner-operators, and independent contractors), the population of owner-operator or independent contractor drivers has grown in recent years.

From 2016 to February 2025, the share of CDL holders working for a one-truck fleet grew from 6.2% to 7.1%; likewise, the share of drivers working for fleets with more than 100 trucks fell from 52.1% in 2016 to 46.1% in 2025.

Racial diversity up

The truck driver population is becoming much more racially diverse.

From 2014 to 2023, the national labor force went from roughly 77% white to 72%. Meanwhile, the truck driver population went from 77% to 63%.

Furthermore, the proportion of Hispanic, Black, and Asian truck drivers grew as follows:

- Hispanic truck drivers increased from 19% in 2014 to 23% in 2023.

- Black truck drivers increased from 15% to 23%.

- Asian drivers increased from 2% to 4%.

The makeup of Hispanic and Black drivers continued to be greater in trucking than in overall U.S. labor demographics.

Gender remains mostly unchanged

Despite the increase in racial diversity, women are not entering the cab. In the national workforce, women represent 47.1% of laborers. Census data from 2023 found that women made up only 4.1% of truck drivers, consistent with previous driver surveys.

About the Author

Jeremy Wolfe

Editor

Editor Jeremy Wolfe joined the FleetOwner team in February 2024. He graduated from the University of Wisconsin-Stevens Point with majors in English and Philosophy. He previously served as Editor for Endeavor Business Media's Water Group publications.