The future of 3PL: Strategic collaborations and tech innovations driving supply chain efficiency

Key takeaways

- Most shippers and 3PLs now focus on strategic partnerships, with regular performance assessments centered on service level agreements and continuous improvement.

- Technology plays a crucial role, with digital supply chains, advanced analytics, and AI being top priorities for enhancing visibility, decision-making, and operational efficiency.

- Barriers such as capital and business case concerns hinder tech investments, but co-investment strategies offer a collaborative solution to foster innovation.

In part one of this series, you learned the current state of the 3PL market and how shippers and 3PLs are shifting from a transactional relationship to a strategic partnership, according to the latest Annual Third-Party Logistics Study from NTT Data and Penn State University. This part of the series dives into how shippers and 3PLs are building strategic partnerships and the investments both parties are making in emerging technologies.

Building a strategic partnership

The study found that regular performance assessments are commonplace between both shippers and 3PLs, especially as shippers and 3PLs prefer more strategic partnerships. Yet, shippers and 3PLs use different tools to assess success, according to the graph below.

While both parties assess service level agreements (90% of shippers and 78% of 3PLs), 3PLs also see continuous improvement targets (72%) and continuous improvement targets with financial penalties (33%) as important assessment factors, more so than shippers (52% and 19%). “This highlights the role 3PLs can play in driving innovation,” the report states.

Stacy Schlachter, SVP of sales at Penske Logistics, said in the report that this is because 3PLs seek to eliminate waste. “We have those expectations of ourselves and want to find ways to be innovative and surprise our customers,” Schlachter said.

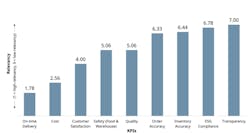

Shippers and 3PLs also measure key performance indicators when assessing the health of a partnership. The most relevant measurement for shippers is on-time delivery, followed by cost.

If both parties are pleased with performance, the partnership will likely continue. The report shows that more than half of shippers (52%) do not automatically rebid at the end of a contract, indicating an “interest to stay with the incumbent provider if they’re receiving the service and outcomes they expect.”

“A continuation of a contract typically shows that a shipper views the 3PL more as a strategic partner than just a vendor,” the report states.

A continuation of a contract can also open opportunities for 3PLs to expand their services, especially as the relationship grows and both companies understand each other’s needs, operations, constraints, and more. Further, 3PLs that offer more services benefit their shipper customers, but it can also benefit the 3PL.

“By covering more areas of the supply chain, 3PLs can reduce fragmentation, streamline operations and communications, improve efficiency, and reduce friction, which provides cost and service benefits,” the report states.

Emerging technologies in the logistics industry

Much like the rest of the world, shippers and 3PLs are increasingly relying on technology within their business operations. The driving force behind technological integrations in the logistics space is largely based on efficiency improvements. Additionally, shippers are now adding technology to their list of must-haves from a logistics provider.

According to the study, 90% of shippers agree that technological capabilities are important when determining a 3PL partner, and 43% of shippers admit to not being satisfied with their 3PL providers’ technology capabilities, signaling the importance of tech and the need for improvement among 3PLs. Further, authors of the study predict that 3PLs that demonstrate IT competency will become more important as shippers prioritize visibility and data analytics.

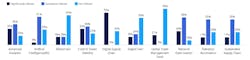

The graphic below indicates shippers’ prioritized technology requirements for 3PLs. Note that the most-used technology priority is the digital supply chain, with 70% of shippers indicating that it’s a requirement among their 3PL partners. The digital supply chain refers to technology that enables supply chain visibility at multiple touchpoints, offering analytics, optimization, and more informed decision-making, according to Coursera. Tied for a shipper’s second-most-used tech tools are advanced analytics and control tower visibility at 35%.

Priorities for 3PLs are slightly different and much more varied. Their highest “significantly used” technology is advanced analytics, but only 31% of 3PL respondents indicated as such. Of the technology categories, most indicate they are “somewhat utilized” or “not utilized” at all. The majority of 3PL respondents (67%) indicated that sustainable supply chain technology is “somewhat utilized” in their operations. Artificial intelligence or machine learning (60%) and advanced analytics (50%) round out the top three most “somewhat utilized” tech categories.

Artificial intelligence and machine learning in logistics

Other emerging technologies making their way into the industry are artificial intelligence (AI) and machine learning (ML). The tech is becoming so prominent that it’s nearly impossible to attend an industry conference without hearing the phrase “artificial intelligence.” Of respondents, 67% of shippers and 73% of 3PLs say they use the technology. Yet, how each company uses the technology varies widely.

The report outlines ways the tech can be used to improve supply chain efficiency: predictive demand forecasting; real-time disruption response; customization and flexibility; cost optimization; strategic decision-making; and workforce efficiency.

Logistics technology companies are also embedding AI and machine learning into their solutions, enabling logistics providers to optimize their operations through predictive analytics, route optimization, partnership optimization, and more, the report states.

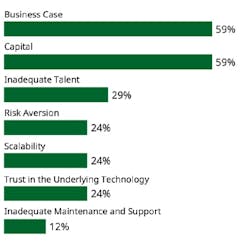

While AI, ML, and other emerging technologies are popular trends in the industry, 3PL respondents cited a few barriers to investment.

Tied as the top barriers to investment are the business case and capital, with 59% of 3PLs identifying these as barriers. In a time when the industry has seen better days, this comes as no surprise. However, this brings an opportunity for 3PLs and shippers to invest in technology together, aiming for a shared beneficial outcome and strengthening a strategic partnership.

“A co-investment is one way both parties can overcome a less-appealing business case,” Allison Dow, director, NTT DATA North America, said in the report.

With a co-investment, neither party will carry the full weight of the financial burden. It’s likely that if both parties invest in the technology, they will have a greater interest in its success. This can help spur growth in a strategic partnership even further.

This is the final installment of a two-part series about the 2026 Third-Party Logistics Study. Read part one here.

About the Author

Jade Brasher

Senior Editor Jade Brasher has covered vocational trucking and fleets since 2018. A graduate of The University of Alabama with a degree in journalism, Jade enjoys telling stories about the people behind the wheel and the intricate processes of the ever-evolving trucking industry.