Trucking By the Numbers 2025: For-Hire vs. Private

This is the second web gallery for FleetOwner's 2025 Trucking By the Numbers. Check out the full list of TBN 2025 galleries here.

As noted in the Trucking By the Numbers 2025 Overview, the average for-hire operating cost is about $2.26 per mile, according to the American Transportation Research Institute. But how does that compare to private costs?

The National Private Truck Council’s latest annual benchmarking survey gives a general look at private fleets’ operating costs. According to NPTC’s survey of 104 companies’ costs in 2024, a private fleet’s operating cost is about $3.81 per mile.

However, this might not be so simple to weigh against ATRI’s measure of for-hire costs. As NPTC’s President and CEO Gary Petty writes, different survey and operational variables might not lead to apples-to-apples comparisons. Petty instead recommends looking at private fleets’ financial performance by “cost per hour of operation per key operating area.” NPTC’s measure of private fleets’ average cost per hour per area is $127,811.

Comparing ATRI’s for-hire fleet cost and NPTC’s private per-mile cost directly (and maybe foolishly) suggests that private fleets cost 50% more to operate. That number might not be accurate to the true cost difference, but industry players still tend to agree that private fleets cost more than their for-hire counterparts.

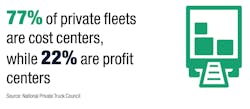

Digging deeper into NPTC’s benchmarking survey, it becomes clearer that private operations tend to cost more. Very few private fleets generate profit: 23% are “profit centers,” while 77% are “cost centers.”

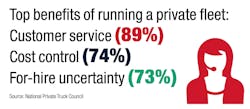

But what these companies lose in operational costs, they gain in stability. Most NPTC respondents noted that the top benefits of running a private fleet are customer service (89%), cost control (74%), and a hedge against outside carrier uncertainty (73%). The latter two benefits were particularly relevant during the topsy-turvy conditions of for-hire operations in the pandemic.

Private fleets retain more drivers

A major bonus for private fleet stability is low driver turnover. While the for-hire sector faces staggering annualized turnover rates (often over 50% in the truckload sector, per ATRI), surveyed private fleets’ driver turnover is only 18.4%.

Higher pay certainly helps with driver retention. Private driver average annual pay is $91,081, while the for-hire sector’s average driver pay is nearer to $76,420 a year.

For-hire profitability is weak

Unfortunately, not all for-hire carriers are “profit centers” today either. According to ATRI’s latest Operational Costs of Trucking report, the average truckload operating margin fell to -2.3%.

A combination of overcapacity and weak freight demand makes up the industry’s infamous freight recession. The worst symptom of this is low-paying freight. The Trucking By the Numbers Overview noted that many fleets are cutting their capacity. As the next TBN section (economics and trade) will describe, freight demand is not improving by much.

Fleets overall might be cutting their population of power units—but private fleets are still increasing their capacity, according to research from ProsperFleet by Valgen. From Sept. 2024 to Sept. 2025, for-hire fleets (carriers with at least 5 registered power units) removed 6,000 power units, while private fleets added roughly 90,000 power units.

Flip through the media gallery above for even more data on driver turnover, for-hire spot/contract rates, and more.

About the Author

Jeremy Wolfe

Editor

Editor Jeremy Wolfe joined the FleetOwner team in February 2024. He graduated from the University of Wisconsin-Stevens Point with majors in English and Philosophy. He previously served as Editor for Endeavor Business Media's Water Group publications.