Inside the rise of logistics automation—from freight matching to fraud defense

Key takeaways

- Mastery Logistics Systems' MasterMind TMS offers scalable, API-first cloud solutions with features like automated freight matching and contract management tailored for large carriers and shippers.

- Prime is moderning its TMS with MasterMind to replace legacy systems, improving real-time data access, operational efficiency, and talent attraction.

- DAT's acquisitions of Trucker Tools and Convoy enhance live tracking, automated updates, and fraud prevention, providing brokers and carriers with trusted transaction platforms and identity verification tools.

Bots and automated systems are finding their way in for-hire trucking—but what does that look like exactly?

Here's a look at how fleets are approaching automated freight matching and transportation management system (TMS) modernization—and how companies like DAT are combating the rise of freight fraud.

Enterprise TMS solutions built for modern carrier, shipper, and broker operations

Mastery Logistics Systems provides the MasterMind TMS, a transportation software-as-a-service for shippers, carriers, brokers, or any combination. The company was founded in 2019 by Jeff Silver, a co-founder of Coyote Logistics.

The premise was to build, at an enterprise scale, a commercially available TMS for mega carriers. It was developed in collaboration with major fleets like Schneider (No. 7 on the FleetOwner 500: For-Hire), Prime (No. 12 on the FO500), Keurig Dr. Pepper, and more.

“MasterMind is designed and built to scale enterprise organizations that have shifted from providing just carrier services or truckload service to be a capacity solution," Prigge said.

Major carriers such as Schneider, a customer of Mastery, have been juggling both their hauls and their own broker operations for years. Customers like these are actively selling not just truckload but also intermodal solutions, serving transportation through rail providers or third-party carriers. Operations like Schneider’s can benefit from a TMS that can do everything.

“It’s not necessarily just a Schneider truck and trailer picking things up anymore. These organizations are maturing in how they go to market for their capacity offering so that they can be a one-stop shop based on what a shipper’s needs are,” Prigge said.

Mastery’s TMS MasterMind is a cloud-native software solution, hosted in Azure with data replication/analysis through Snowflake. The tech stack is geared to, as Prigge puts it, “high uptime, high redundancy, and access to data in real time.” The platform’s features are built on an application programming interface (API), first for easy integration with other technologies.

“If you see something in the mastermind UI, it’s intended to have an API endpoint,” Prigge explained.

Fitting the theme of automation, the platform also has features for automated freight matching, contract management, and back-office documentation.

“We have the ability to say to an end-user, 'Here are 10 loads that match, but here are the three that are the best based on when the truck is empty, when and where it’s available, and where that truck desires to get to,'” Prigge said. “We are helping those brokers offer freight that actually works for that third-party carrier.”

How Prime Inc. modernized legacy systems with Mastery’s MasterMind TMS

Prime Inc. is one of those many carriers that offers more than its extensive fleet: It also acts as a freight broker and logistics service provider for owner-operators and fleet owners.

Jeff Silver, Mastery's founder, was known to Prime from his time at Coyote. The company began having conversations with him during the beginning stages of his work on Mastery. They were interested in the direction that the MasterMind TMS was heading.

“As it’s designed, it can cover everything a TMS needs from your entire enterprise, and that was very attractive to us,” Jim Guthrie, director of operations for Prime, told FleetOwner. “Industry-wide, between carriers and shippers, you’re finding that everybody’s working in conjunction to find the technological solutions of the future that help with real-time tracking, updating, and automation around those tasks. There’s a big demand for more of that data and more information to push to different interested parties within the supply chain.”

Legacy platforms are an age-old problem for enduring businesses. Older platforms can be deeply embedded within the operations of a business—they also require continuously greater effort to modernize and face an aging workforce to support them.

“If you look at the technical landscape that exists in the carrier space, there’s still a lot of organizations running on legacy platforms like ICC—aka, old AS/400 technology, which is super stable but definitely has its limitations, both functionally as well as from a technical standpoint,” Prigge said.

Prime had been using a highly modified ICC system, which utilizes IBM’s AS/400 technology, to support its offerings for years.

“Prime, like many carriers in this industry, has really worn out, programmed, modified, and bandaged our legacy systems for years and years. There hasn’t been a new package in the industry that was all-encompassing for the future, for everything that’s needed to manage assets. There’s brokerage platforms, but not really from a carrier asset management perspective.”

The company was also interested in the automation of menial clerical tasks. Newer tech, a step up from old-school IBM platforms, was also a promising way to attract and retain talent.

“The old AS/400-based green screens aren’t very attractive to young kids coming out of college nowadays,” Guthrie said. “In fact, they look at those and wonder what century we’re living in.”

Prime announced it would begin integrating MasterMind into its operations in 2021, first bringing in its brokerage offering, then moving to its intermodal, asset, and power-only offerings.

Today, the company is making progress in integrating its operations into the system. Its brokerage division is fully on board with the platform. It hopes to have its intermodal and assets divisions fully integrated in the next 12 months.

DAT expands automation to streamline broker-carrier workflows and fight freight fraud

DAT is expanding its offerings to better accommodate these industry trends. The company made major acquisitions over the last year for freight tracking, identity verification, and freight matching services.

Automating visibility: Real-time freight tracking and digital status updates

The company’s acquisition of Trucker Tools in December 2024 brought robust live tracking to support its freight ecosystem.

DAT brought in the tracking platform as DAT One’s primary tracking provider. Carriers can integrate their ELD via the DAT One app. The platform has integrations with over 250 ELD providers. Carriers that consent to ELD integration can provide automated location updates to brokers. Brokers can then make sure their shippers have the information they need.

“We know that truck drivers and carriers hate receiving check calls from brokers asking them, ‘Where are you? When are you going to be there? Are you running late?’ What our technology does is automate the entire process for drivers,” Jablonski, who joined DAT with the acquisition, said.

Trucker Tools also has document scanning to associate it with specific loads through the app.

“When a load is booked on there, you can also kick off a tracking link if you’re a Trucker Tools customer. It makes it easy and seamless,” Jablonski added.

Transaction automation and identity verification: DAT’s next step in digital freight matching

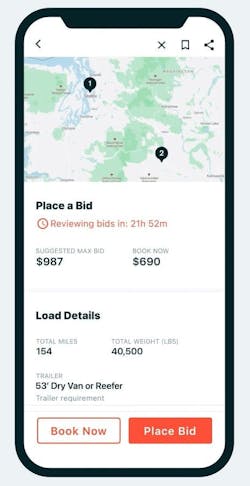

DAT’s most recent acquisition takes direct aim at automated freight matching and fraud blocking. The Convoy Platform provides brokers with transaction automation and verified carriers.

“At DAT, we’re aggregating a lot of publicly available and proprietary data that we have to help make sure that brokers and carriers have a full picture of the other person before they even begin engaging in the relationship,” Jablonski said. “Our recent Convoy acquisition takes that to the next level with some really sophisticated identity verification technology.”

Convoy was a brokerage that ran from 2015 until it suddenly shuttered in 2023, its CEO blaming the freight recession. Supply chain logistics platform Flexport bought the Convoy tech stack after the company’s closure and launched the Convoy platform in early 2024. Flexport sold the assets to DAT in July of this year.

Convoy asks carriers for “the pretty standard information that they get asked by brokers when they onboard into their networks” and verifies that against public data, such as FMCSA operating authority, Jablonski said.

Convoy is a separate platform from the DAT One app, but the company plans to bring both together over time. Carriers today must go through independent onboarding processes for both platforms.

But the platform goes beyond identity verification; it also helps brokers find carriers and helps carriers boost their visibility.

“It allows brokers to access this massive pool of trusted capacity but also to automate matching, booking, and execution of a load,” Jablonski said. “I think that’s the value for users on the broker side and the carrier side. They can automatically negotiate back and forth—they don’t have to wait for responses from brokers—and then book, receive documents, and onboard, all within one single mobile app … The Convoy platform is great for essentially acting as another carrier sales rep, enabling you to book loads, vet carriers, onboard carriers, and pay carriers.”

This is part two of a two-part article series on logistics automation. Read part one here.

About the Author

Jeremy Wolfe

Editor

Editor Jeremy Wolfe joined the FleetOwner team in February 2024. He graduated from the University of Wisconsin-Stevens Point with majors in English and Philosophy. He previously served as Editor for Endeavor Business Media's Water Group publications.