Analysts revisit truckload forecast, cite ongoing carrier, shipper concerns

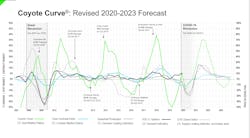

Trucking industry analysts have projected a relatively slow recovery from the pandemic-induced recession. One of those analysts, Chris Pickett, chief strategy officer for Coyote Logistics, noted that recession recovery will remain the dominant theme of 2020, with another year of an inflationary spot market through the first quarter of 2021.

Pickett, during a May 21 Coyote Logistics webinar on how the coronavirus has impacted the market, explained that the second quarter of 2020 will be the bottom in terms of the freight market, with spot rates somewhere between -5 and -7.5%.

“We believe the market found the floor really about three weeks ago,” Pickett said, noting there has been a 16% rise in rates over the past few weeks.

“If the economy continues to reopen from here and we don’t get a relapse, we would certainly expect the May numbers to look better than the April numbers,” he added.

Coyote also published a “Q2 2020 Coyote Curve Market Guide” based on its panel discussion. As of May 20, here is Coyote’s breakdown from its Q2 2020 mid-quarter review:

- Coyote Curve Index (spot rate proxy): -9%

- Cass Linehaul Index (contract rate proxy): -6.2%

- ATA Truckload Volume (demand indicator): +5.3%

- DOE Diesel Index (supply indicator): -20.5%

Coyote uses the American Trucking Association’s (ATA) volume index as its proxy for shipment volume in the truckload market. Despite a historically bad economy, as of late May, ATA’s index showed +5.3%, mainly because the index is derived from ATA-member carriers filling out surveys every month, and it’s rooted in their perception, Pickett explained.

Typically, both the Cass and the ATA volume indices closely track IP. The ATA index represents the carrier community, versus the Cass index, which represents shippers.

Carrier and shipper challenges

During the webinar, Coyote Logistics executives J-Ann Tio, senior vice president of business operations, and Mike Sinkovitz, vice president of CTM operations, also spoke about challenges that shippers and carriers have faced relating to COVID-19. Sinkovitz explained that although challenges vary by product line and location, nearly all shippers are experiencing some form of disruption caused by the pandemic.

“There has been a lack of clarity around government regulations that has created confusion, changes to sourcing locations, and volatility in order patterns are certainly creating changes in sourcing patterns,” he said. “Those who do not have active demand are going through furloughs or terminations, all while trying to create a safe space to work for when their employees do return to their facilities.”

For carriers, Tio said volume has been relatively inactive due to lack of customer demand and shutdowns. A significant challenge for carriers has been rates, she added. But over the last two weeks or so, volume has begun to rebound.

“We see carriers and drivers evolving,” she said. “Drivers have been more flexible on their routes than ever because some partners are shipping, and some partners are simply not right now. Trying to figure out whether they are getting the weekly revenue they need to keep up with their operation has meant some shifts in portfolio management as far as what volumes are moving.”

Dwell time, or detention, incurred at shipping facilities has always been a supply chain challenge for carriers. However, it’s even more concerning for carriers right now.

Road to recovery

Sinkovitz noted that when it comes to making it through this economic downturn, “a little shared empathy goes a long way.” Coyote also provided takeaways for carriers and shippers as they prepare for recovery.

For shippers:

- Develop a thorough return-to-work strategy. Document the process and communicate with employees.

- Have a firm understanding of regulations. Though there has been a lack of clarity from a federal level, go local. Ask local police departments and Chambers of Commerce for advice and best practices.

- Contact strategic providers. Whether it’s a supplier or a carrier, know what will be available in the coming months, both in terms of inventory and how to move it.

- Add flexibility. Find out ways to simplify production. Pare back product lines and minimize stock keeping unit counts. Make the shift with a mind towards in-home consumption. Work with providers that can help shippers pivot quickly.

- Stick to KPIs. Don’t let the current chaos distract from core performance indicators for your carrier base. Track performance and hold carriers accountable.

For carriers:

- Have a solid understanding of money owed to you. Revisit outstanding accessorials and follow up with providers. Make sure the revenue you earned is getting into your account.

- Revisit payment terms. Look at how you are getting paid from each provider. Are there ways to get paid faster to boost cash flow?

- Reexamine network needs. Things have changed dramatically over the past few months, and the usual lanes you used to run may no longer be valid. Have a clear understanding of what today’s network looks like.

- Have a strategic call with shippers. Reach out to see what shippers’ forecast needs are, especially those not currently shipping. Try to get a realistic look into their supply chain needs for the remainder of the year.

About the Author

Cristina Commendatore

Cristina Commendatore is a past FleetOwner editor-in-chief. She wrote for the publication from 2015 to 2023.