Spot truckload rates lag as more truckers search for loads

Spot truckload freight volume fell 2% during the week ending April 7 while a 9% increase in available capacity kept van and refrigerated rates from moving, said DAT Solutions, which operates the DAT network of load boards.

One reason for the increased supply of trucks: slow produce harvests have prompted reefer carriers to compete for spot van freight.

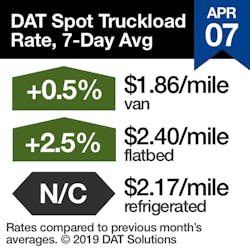

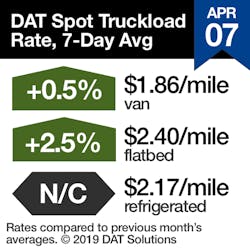

National average spot rates through April 7:

- Van: $1.86/mile, 1 cent higher than the March average

- Reefer: $2.17/mile, same as the March average

- Flatbed: $2.40/mile, 6 cents higher than March

Diesel prices increased a penny to $3.09 per gallon.

Van trends: Van volumes declined compared to the previous week—not unusual for early April, since there was extra activity in late March for the close of Q1. There are actually more van loads moving on the spot market than at this time last year.

But there are also plenty of trucks available. The van load-to-truck ratio declined last week to 1.3 loads per truck.

Markets to watch: Rates rose on just 38 of the top 100 van lanes while 58 lanes fell and four were unchanged. No lanes in the top 100 rose by more than 10 cents per mile, although two notable lanes were close:

- Los Angeles to Atlanta added 8 cents to $1.58/mile

- Memphis to Columbus increased 9 cents to $1.96/mile

Columbus to Memphis, on the other hand, fell 14 cents to $1.70/mile, and Houston to Oklahoma City, which jumped two weeks ago, fell back 12 cents to $1.92/mile.

Reefer trends: Pricing has been volatile on individual lanes, but the national average reefer rate was unchanged last week. On the top 72 reefer lanes, rates on 36 were up, 33 were down, and three stayed the same.

Nationally, spot reefer volume fell 1% but expectations are increasing with spring weather.

Markets to watch: In Florida, Miami outbound volumes jumped 23% last week and were nearly 9% higher from Lakeland. But the Miami market (south Florida) had lots of trucks, which kept rates from rising, while Lakeland to Atlanta jumped 23 cents to $1.66/mile.

On the Mexican border, reefer freight volume increased 20% at Nogales, Arizona.

DAT Trendlines are generated using DAT RateView, which provides real-time reports on spot market and contract rates, as well as historical rate and capacity trends. The RateView database is comprised of more than $60 billion in freight payments. DAT load boards average 1.2 million load posts searched per business day.

About the Author

Fleet Owner Staff

Our Editorial Team

Kevin Jones, Editorial Director, Commercial Vehicle Group

Cristina Commendatore, Executive Editor

Scott Achelpohl, Managing Editor

Josh Fisher, Senior Editor

Catharine Conway, Digital Editor

Eric Van Egeren, Art Director