DAT: Spot-market volume climbs 3% in July

July resulted in an historic positive marker for truckload spot-market volume, according to DAT. For the month, July beat June levels for the first time since DAT began tracking these monthly statistics back in 1996.

Spot -load volume was up 3.0% for the month—that compares remarkably to the 20% average decline from June to July seen over the past 10 years.

However, spot-market load volume dropped 6.1% on the DAT Network of load boards for the week ending August 3, but DAT said that was “in line with seasonal norms.”

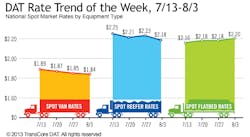

Spot rates were also positive overall. According to DAT, “spot rates slipped seasonally but stayed relatively strong for the end of July and early August.”

The national average van rate slipped 1 cent to $1.84 per mile (all rates include fuel surcharge); reefer rates fell 5 cents to $2.18 per mile; and flatbed rates rose 2 cents to $2.20 per mile.

Van freight

Indeed, at $1.84 per mile, DAT said the national average spot-market rate for van freight “remained high for late summer.”

The company pointed out that “van-freight availability increased 3.0%, an unusual trend in the spot market, and capacity expanded even more.” The load-to-truck ratio as a national average increased from 2.3 to 2.6 week-over-week. DAT noted that load-to-truck ratios represent the number of loads posted for every truck posted on its network of load boards.

“Though rates were down in most major markets in the United States, Buffalo and Philadelphia rates strengthened over last week,” DAT said. Outbound Buffalo spot van rates were up 17 cents to $1.71 per mile, and Philadelphia rates rose 7 cents to $1.63.

“Van rates finally began to drop in late July on the spot market,” observed DAT industry pricing analyst Mark Montague. “I say ‘finally’ because rates rose at the beginning of July and remained unusually strong for the first half of the month, which is not the typical pattern.

“While national average rates began their downward trend early in the month, they did not drop below the $1.88 per mile — the average rate for June — until July 20, when a handful of markets retained their pricing strength,” he continued.

“Freight is still plentiful, and demand for trucks remains solid going into the back-to-school season,” Montague added. “It appears that capacity is more readily available in most parts of the country, however, relieving some of the pressure from late June and early July.”

Reefer freight

The average spot-market rate for refrigerated trailers lost 5 cents as a national average last week, “signaling an end to an unusually long peak season.” Still, DAT observed that “the average spot-market rate remains high for late summer, at $2.18 including fuel.

As to key markets, DAT said that outbound rates from Fresno fell 8 cents to an average of $2.38 per mile “as load availability took a steep drop.” On the other hand, Green Bay jumped 9 cents last week to $2.26 per mile.

Reefer load availability rose 7.1% last week, matching mid-July levels. The load-to-truck ratio returned to 7.5, rising from 7.1 the previous week.

Flatbed freight

Nationwide, flatbed load availability dropped 4.5% last week. But, pointed out DAT, for the month of July, loads were up 6.0% compared to June.

Flatbed capacity lost 6.5% for the week, but gained 9.6% month-over-month. The load-to-truck ratio for flatbeds rose slightly to 20.8 for the week.

Rates reported by DAT are derived from the DAT RateView and the DAT Network of load boards.

Click here for a complete national and regional report by DAT on spot rates and demand.