Despite measures to send relief to industries such as trucking and consumers who are paying sky-high prices at the pump, the U.S. average for diesel remained historically high the week of April 4, dropping only 4.1 cents to $5.144 per gallon, according to the U.S. Energy Information Administration (EIA).

Trucking's main fuel has stayed well above $5 for three weeks since it leaped almost 75 cents to $4.849 in the market shock the first week of March when Russia invaded neighboring Ukraine. It's been on the rise since, with only slight relief some weeks.

See also: After a dip, U.S. diesel prices back on the rise

The U.S. average for a gallon of gasoline, meanwhile, dropped 6.1 cents to $4.170 in a second straight week of slight declines. Gasoline began to level off the week of March 28, when it was down less than a penny to $4.231 from $4.239. Gas, however, has been above $4 a gallon nationwide now for four straight weeks since early March, according to EIA.

The Biden administration also announced on March 31 that the president had approved the largest-ever release of oil from the Strategic Petroleum Reserve. But the effect on prices of that release of 1 million barrels a day from the reserve over six months—for a total outlay of about 180 million barrels that dwarfs previous emergency releases—might not be seen in the market for weeks.

Oil is still stubbornly above $100 per barrel but has descended from highs closer to $115 just last week.

A new $5-a-gallon 'normal'?

Diesel is down slightly across the U.S., with the Rocky Mountains the only region showing an increase for the week of April 4, though the bump there was slight—up 1.1 cents to $5.055.

In California, the most expensive for trucking's primary fuel, the per-gallon price did not rise at all from the week of March 28, staying flat at $6.289. Overall, the West Coast price, which includes the Golden State, was down 4.2 cents to $5.832, making it easily the most expensive region for diesel. The Golden State is also where fleet sustainability efforts and electrification is most prominent in the country.

Next was the East Coast, where diesel was down 4.3 cents from the week of March 28 to $5.206. In the East, diesel was priciest in the Central Atlantic region (but down 3.7 cents to $5.363), followed by New England (down 2.6 cents to $5.283), and the Lower Atlantic (down 5 cents to $5.095). Midwest diesel was down 4.7 cents to $4.947, and along the Gulf Coast, it declined 4.3 cents to $4.929.

The U.S. Department of Energy will use the revenue from the release to restock the Strategic Reserve in future years. This will provide a signal of future demand, help encourage domestic production today, and ensure the reserve's continued readiness to respond to future emergencies, according to the Biden administration statement.

The U.S. average for a gallon of gasoline, meanwhile, dropped 6.1 cents to $4.170 in a second straight week of slight declines. Gasoline began to level off the week of March 28, when it was down less than a penny to $4.231 from $4.239. Gas, however, has been above $4 a gallon nationwide now for four straight weeks since early March, according to EIA.

State capitals and the federal government are beginning to take the only steps they can to address prices at the pump in a marketplace that operates largely out of control of governments.

See also: DOT sets new CAFE standards for light-duty vehicles

Three states—Connecticut, Maryland, and Georgia—have temporarily suspended their gas taxes to help their residents save money, and more states might make similar leaps as the usual summer season price hikes approach. California, which has one of the highest gas taxes in the nation at around 51 cents per gallon, is considering a gas tax holiday and a $11 billion proposal that would send debit cards valued at $400 per owned vehicle, capped at $800 per family. And governors from six other states have urged Congress to suspend the federal government's 18.4-cent-a-gallon gas tax through 2022.

High prices will take time to stabilize

Meanwhile, refiners told Oil & Gas Journal, a FleetOwner affiliate publication, that high prices will not be going away easily.

A refiners' association on April 4 held a news briefing to talk about crude supply problems, recovering product demand, and domestic infrastructure limits that are supporting historically high prices.

Susan Grissom, chief industry analyst at the American Fuel & Petrochemical Manufacturers, and John Auers, executive VP of consulting company Turner, Mason & Co., laid out the explanations and warned that a rebalancing of the crude and product markets will not necessarily be swift.

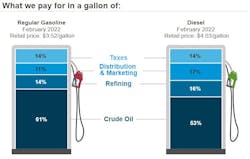

Crude oil accounts for about 60% of the cost of oil products, Grissom said. The Russian invasion of Ukraine has triggered a U.S. ban on Russian oil imports, and while that is a contributing factor to market problems, U.S. refiners will cope, Grissom and Auers said.

American refiners already were well on their way to cutting Russian oil use before the sanctions, as shown by the sharp successive import reductions during December and January, Auers noted.

"Replacing Venezuelan heavy crude was a much more challenging task," he said, referring to Trump administration trade sanctions in 2019.

The Russian imports in 2021 especially included unfinished feedstocks, notably vacuum gasoil and residual oil, and a few refiners were running the bulk of them, Auers said.

Grissom stressed the market gyrations are being caused by the pandemic and, at the same time, reductions in crude refining capacity. Recovery from the pandemic by consumers has occurred faster than oil production by U.S. companies, she said, and that has helped boost prices for both crude oil and refined products such as diesel and gasoline.

About the Author

Scott Achelpohl

Managing Editor

Scott Achelpohl is a former FleetOwner managing editor who wrote for the publication from 2021 to 2023. Since 2023, he has served as managing editor of Endeavor Business Media's Smart Industry, a FleetOwner affiliate.