So much for any downward trend in diesel prices.

The roller-coaster ride for trucking’s main fuel headed uphill again during the week of April 18 as the nationwide average price rose 2.8 cents to $5.101 per gallon, according to the newest report on distillate prices and trends from the U.S. Energy Information Administration.

The price of diesel nationwide—and in all but two regions of the U.S.—sits stubbornly above $5 per gallon and remains almost $2 more than a year ago. Diesel has budged only about 15 cents from its highest price ever, reached in mid-March, of $5.25 per gallon, according to EIA.

See also: Diesel drops for the second week in a row

The Midwest (still up 3.4 cents to $4.921) and the Gulf Coast (also up 1.5 cents to $4.855) were the only regions of the country where diesel prices sat below $5 per gallon. The only region or subregion where diesel actually fell was New England, where it was down less than a penny to $5.177. Diesel on the entire East Coast, meanwhile, rose 2.3 cents to $5.151 per gallon.

As it usually is, California during the week of April 18 was the most expensive place in the nation (up 2.7 cents to $6.25) to buy diesel, accounting for why all of the West Coast held the distinction as the priciest region (up 3.4 cents to $5.795 per gallon) for trucking’s most consumed fuel.

But gas in many regions dropped or stayed below the $4 mark, with only the Rocky Mountains staying above that mark. Gas remained slightly above $5 per gallon on the West Coast. Gas rose in only two regions, the Rockies and the Gulf Coast, but those increases were less than a penny.

To the extent that U.S. distillate prices track with crude oil prices, there seems to be correlation. Though U.S. crude inventories are higher, so now is the price of WTI and Brent crude, which flirted with falling below $100 per barrel last week but was back up on April 19 to about $110 per barrel. Some weeks ago, oil prices floated at or above $115 per barrel.

Fuel, surcharges, demand push freight costs higher

Meanwhile, the April 2022 Cowen/AFS Freight Index predicted that fuel surcharges—driven by the higher prices for diesel together with other market forces—will push parcel rates and less-than-truckload freight rates to record highs, while truckload growth rates are expected to ease.

Dramatically higher fuel surcharges are the primary driver of the accelerated growth in LTL and parcel costs in the second quarter of 2022, while driver shortages and labor costs support continued truckload growth even as forecasted demand softens, according to the index, which was released April 12 by third-party logistics provider AFS Logistics and Cowen Research.

“Shippers should expect rising rates across the board, as those higher fuel surcharges join the usual suspects like capacity constraints, GRIs [general rate increases], firm pricing policies, and steep accessorial increases to intensify upward pricing pressure,” Nightingale added.

“Truckload carriers continue to wield contractual pricing power, even as waning demand and increased capacity from smaller fleets hit spot prices hard," said Jason Seidl, Cowen’s senior analyst for air freight and surface transportation. “Consumer spending habits, inflation impacts, and demand shifts from pending infrastructure projects are likely to have a big impact on 2022 pricing trends."

See also: Diesel prices ease—but only slightly

Data from the AFS/Cowen Index release indicates continued rate-per-mile increases, albeit at a slower rate compared to 2021. Compared to the January 2018 baselines, the index is expected to grow from 25.2% in the first quarter and plateau at 27.1% in Q2 2022, a lower growth rate than previous quarters.

Fuel costs were a major driver of cost-per-shipment growth in Q1 this year and increases are expected in the second quarter. Disruptions to global oil supply and continued high demand resulted in LTL carriers adjusting fuel surcharge tables, causing significant increases to fuel-related costs in the first quarter.

The two largest parcel carriers, FedEx Corp. and UPS Inc., both recently implemented significant changes to fuel surcharges, resulting in increases of 129% in express parcel and 89% for ground parcel compared to October 2021. The fuel surcharge increases outpaced corresponding indices that drive fuel surcharge levels published by EIA.

Small fleets suffer as diesel stays high

Smaller commercial fleets and independent owner-operators suffer the most when diesel prices spike because they have little or no access to bulk fuel discounts that larger carriers negotiate with truck-stop operators such as Love’s and TravelCenters of America. Sometimes, however, an owner-operator can get access to discounted fuel if they affiliate with a larger fleet for a sustained period.

A saving grace for small operators, the president and CEO of a Midwest-based auto transport platform said, might be that fuel surcharges have been baked into the market for about a year as diesel prices have been increasing steadily over that time—though an almost 75-cent shock to the nationwide average for diesel came after the Russian invasion of Ukraine in mid-March.

Dimitre Kirilov of Schaumburg, Illinois-based Montway Auto Transport runs a logistics brokerage that has about 7,000 active carriers as its members and operates in all 50 states and Europe, so Kirilov said he has plenty of exposure to smaller operators as they navigate a tricky transportation environment that includes these historically high fuel prices.

Almost all the fleets of his brokerage burn diesel in their trucks with very few exceptions—and they do not qualify for bulk discounts on distillates. “We’re trying to create more robust carrier relations so we can get our fleets access to discounted fuel,” Kirilov added.

A large component of his job is to track spot market vs. contract freight pricing, so he’s been seeing how rates have tracked with diesel prices, demand, and other factors mentioned in freight market measures such as the Cowen/AFS Freight Index and on the DAT Load Board.

Kirilov’s view is a market correction of sorts is underway since fuel prices were artificially low during the COVID-19 pandemic. He said the U.S. market is biased anyways because diesel prices here are historically much lower than they are in other developed countries.

And the Montway Auto Transport chief said he has been watching as some states and the federal government have instituted or are weighing fuel-tax holidays to try to ease price pressure on commercial fleets and consumers headed into the busy summer travel season.

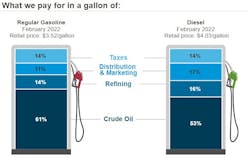

“There’re a couple of things to consider here. There’s a reason the cost of fuel is much lower in the U.S. then it is in the rest of the world. It’s because the taxes on fuel are low here,” Kirilov said. “I welcome any relief any of the carriers can get, because it might mean fewer carriers come in and exit quickly. Any little relief helps.”

About the Author

Scott Achelpohl

Managing Editor

Scott Achelpohl is a former FleetOwner managing editor who wrote for the publication from 2021 to 2023. Since 2023, he has served as managing editor of Endeavor Business Media's Smart Industry, a FleetOwner affiliate.