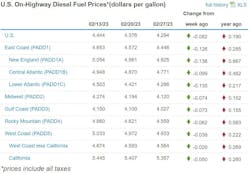

The U.S. average price for diesel fuel is on a roll after dropping for the fourth consecutive week, by 8.2 cents to $4.294 per gallon for the week of Feb. 27, according to the newest U.S. Energy Information Administration (EIA) data.

The nationwide average for trucking’s main fuel has shed more than 30 cents in the last month. It sits just 19 cents above its level of a year ago—another significant milestone because the U.S. price floated around $1.50 more than its year-ago level just last summer.

See also: Small fleets, owner-operators struggle living off current spot market

And the EIA data likely will be turned on its head next week, which is the first anniversary of the largest diesel increase on record with the federal energy tracker—74.5 cents—in the immediate aftermath and energy market aftershocks from the Russian invasion of neighboring Ukraine.

Motor club AAA saw its U.S. diesel average decline every day this and last week. AAA's diesel average was down 7.1 cents to $4.409 per gallon by the morning of Feb. 28, and the motor club's average has fallen 28 cents this past month.

Regional picture more telling for truckers

The regional outlook for diesel continues to improve more than even the average for the U.S.

Prices are down for the week of Feb. 27 in every region of the country—substantially in most. For example, the price for trucking's main fuel is 12.6 cents lower than last week to $4.446 per gallon along the East Coast, and two subregions of the East (New England, down 13.6 cents to $4.825, and the Lower Atlantic, 13.5 cents lower to $4.286 per gallon) declined more. The third East Coast subregion, the Central Atlantic, slid almost a dime per gallon to $4.771.

Hows and whys of declining fuel prices

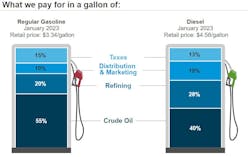

What is sustaining this period of dropping diesel and gas prices? In its Short-Term Energy Outlook, EIA predicts diesel and gasoline prices will drop much more in 2023 and 2024, but the immediate answer in real time derives from a combination of factors.

The basic answer is global demand for crude is down now but is predicted to see a limited increase, oil production in the U.S. is going up and is making up for lower Organization of the Petroleum Exporting Countries output, refinery production in America is higher, prices for crude oil on the various markets have stayed consistently lower than they were last year, and U.S. crude inventories are higher. All these factors are pushing prices at the pump lower for everyone.

See also: Freight markets remain in a lull ahead of projected upturn

"Even as prices decrease, the expectation is U.S. refiners will keep producing gasoline and diesel to keep up with increased global demand—which will directly benefit U.S. gas and diesel prices in 2023 and theoretically keep them down," a recent Intek Freight & Logistics forecast of diesel price trends for 2023 added.

"Diesel prices have a direct correlation to freight costs, and 2023 will be no exception," Intek goes on to say in its forecast. "In fact, diesel, along with linehaul, are the main components of freight pricing. When it comes to linehaul, spot rates have been trending down and contract rates have followed to a degree. While both will rebound, they are expected to stay below the especially elevated levels of the past couple of years. Combine that with the expectation of reduced diesel prices in 2023, and overall freight costs should be down this year."

About the Author

Scott Achelpohl

Managing Editor

Scott Achelpohl is a former FleetOwner managing editor who wrote for the publication from 2021 to 2023. Since 2023, he has served as managing editor of Endeavor Business Media's Smart Industry, a FleetOwner affiliate.