Shippers are reevaluating costs, carrier partnerships ahead of market flip

Shippers had the upper hand for a few years—but are now preparing for anticipated rate increases.

Freight market forecasts expect better conditions for carriers in the second half of 2025. Annual industry reports predict truck volumes to grow about 1.6%, and leading analysts predict a rate upturn later in the year. The transportation market has a bright outlook for fleets.

“There is some anticipation that, as demand increases, we will see the market dynamics change,” Jenny Vander Zanden, COO of Breakthrough, told FleetOwner. “We are seeing this as a gradual shift as demand is increasing.”

In its 2025 Freight Trends analysis, Breakthrough also predicts freight demand and linehaul rates to rise gradually. The company expects freight demand to average 1.4% growth beginning in May. It also predicts dry van contract rates to increase by 3.2% and dry van spot rates to jump by 9% throughout 2025.

For Breakthrough’s 2025 survey, cost is once again a leading concern for shippers. When establishing carrier partnerships, 57% of shippers list cost as the top consideration, making it the most critical factor among surveyed shippers.

On-time services (48%) and favorable shipment schedules (37%) are also top concerns for shippers in 2025, according to the 350 respondents.

The issue is not as universal as it was in previous surveys. Cost was a bigger consideration in Breakthrough’s 2023 outlook survey: 77% of respondents in March 2023 listed cost as a key issue. However, the consideration fell off Breakthrough’s top three in 2024, a year defined by low rates.

Adjusting strategies

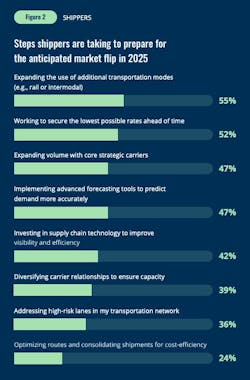

Shippers’ strategies for 2025 reflect their concerns about cost; many respondents are looking to cut expenses and optimize operations. Shippers are shifting their strategies for the market flip by chasing lower rates ahead of time, carefully considering their transportation partners, and investing in supply chain technology.

The top strategy for shippers according to Breakthrough is in weighing alternative transportation modes for their loads. The majority (55%) of respondents list using other modes such as rail or intermodal as one of the ways they will prepare for market change.

Securing lower rates ahead of time (52%), expanding volume with core strategic carriers (47%), and investing in supply chain technology (42%) are also top strategies among surveyed shippers.

Notably, while almost half of shippers focus their volumes with key partners, 39% of respondents plan to diversify their carrier relationships to ensure capacity.

“It is split as we look to the forward market: there’s a number of shippers that are diversifying their carrier base, and there’s a number of shippers that are consolidating their carrier base,” Vander Zanden said.

Carriers plan to expand

While shippers look to reducing costs, carriers hope the market will help them grow.

The survey’s 150 carrier respondents plan to expand their fleet size or services (49%), sign more contracts with shippers (44%), and raise prices or renegotiate contracts with existing shippers (43%).

About the survey

This latest report is Breakthrough’s third survey of transportation professionals about their strategies and predictions for the next 12 months. Each year since 2022, Breakthrough surveyed 500 transportation decision-makers, including directors, senior managers, and more.

This year, Breakthrough surveyed 350 shippers and 150 carriers in November 2024. Respondents shared their operational plans, disruption expectations, sustainability goals, and more.

See also: Trucking's capacity outlook for 2025

But how are shippers and carriers reacting to these forecasts?

According to survey responses in Breakthrough’s 2025 State of Transportation Report, shippers plan to reduce costs and re-evaluate their transportation partnerships. Carriers, meanwhile, hope to raise rates and expand operations.

Shippers want to cut expenses

Many shippers are turning their attention toward cost-saving opportunities.

Risk of disruptions

Rising freight demand is not the only event poised to shake up the year’s transportation market. Possible disruptions could range from temporary events like inclement weather, supply chain shortages, and labor conflicts to long-term market shifts like regulatory changes or macroeconomic trends.

See also: How to ensure a safe fleet during inclement weather

Both shippers and carriers expressed confidence in their ability to adapt to future transportation disruptions: 37% feel they are very prepared for disruptions, 55% are somewhat prepared, and only 9% confess to feeling unprepared.

Vander Zanden stressed that decision-makers’ reactions to disruptions will depend on their critical inputs and that they should be aware of and survey their landscapes.

“There’s not one thing that impacts everybody the same way,” she said. “It’s important for people in transportation to understand and assess those disruptions based on where they’re located, what their material inputs are, what types of tariff influences could happen that change the location of product you might be sourcing, and to understand how your company is doing so that you’re able to adapt.”

About the Author

Jeremy Wolfe

Editor

Editor Jeremy Wolfe joined the FleetOwner team in February 2024. He graduated from the University of Wisconsin-Stevens Point with majors in English and Philosophy. He previously served as Editor for Endeavor Business Media's Water Group publications.