Trucking conditions fell in October due to a surge in diesel prices. According to FTR Intel, if fuel prices had been a neutral factor, October’s reading of 7.75—the weakest reading since July 2020—would have been negligible.

Freight rates remain the largest positive factor, although they were modestly less positive in October. However, freight volume and utilization were stronger positive factors than they had been in September with a reading of 11.79. FTR reports that fuel costs have now stabilized, and the outlook is for solidly positive readings well into 2022.

See also: Waiting for the dam to burst: Pent-up demand held back by supply chain

“October was an outlier due to the brief surge in diesel prices, but conditions in 2022 are unlikely to be quite as robust for carriers as they are today,” said Avery Vise, VP of trucking at FTR. “We expect slower growth in freight volume and a slight easing of capacity utilization resulting in a gradual stabilization of freight rates at an elevated level."

“Even so, market conditions should favor carriers at least into 2023,” Vise noted. “Potential downside risks for this outlook include further gains in driver capacity and sharply reduced consumer spending due to inflation and a loss of stimulus. However, the pent-up demand in the automotive sector could offset any softening due to those factors.”

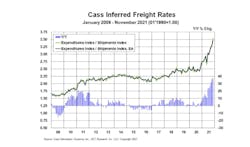

According to the Cass Freight Index, freight rates were 38% higher year-over-year in November, up from the 36% year-over-year increase in October. Inferred rates, which explain the overall movement in cost per shipment, rose 5.5% month-over-month on a seasonally adjusted basis in November in the fourth straight month-over-month increase."Significant excess miles are continuing in the freight network due to myriad supply chain disruptions in the shortage economy of 2021," according to Cass. "Chassis production has improved significantly in the past two months, but the chassis fleet remains far from what is needed to address rail network congestion, so imports continue onto truckload, particularly off the West Coast, considerably raising the length of haul as trucking continues to take share from a snarled rail network."

These excess miles, Cass pointed out, are a significant part of the 38% year-over-year increase in inferred freight rates, as these rates are on a per-shipment basis, rather than a per-mile basis. Higher fuel surcharges are part of the increases, as are modal mix, accessorial fees, and significantly longer lengths of haul due to intermodal service issues, Cass noted.

“Freight volumes remain capacity-constrained, as shown by declining rail volumes and the ongoing backlog of containerships outside of U.S. ports,” Cass said. “Although little progress has been made on the ocean as of yet, the pickup in our shipments index [see below] shows progress as the freight industry works to de-bottleneck. One important example of this is recent easing in semiconductor shortages, as shown by improving automotive rail carloadings.”