Continued supply chain challenges strain 3PL, shipper relationships

Supply chain challenges are still straining third-party logistics and shipper relationships—a problem that industry stakeholders fear could extend into next year, according to an annual 3PL study released today. Both shippers and 3PLs expect more from technology as human talent gets harder to find and consumers and businesses rely more on physical and data-driven supply chains.

While fewer shippers are finding 3PL relationships successful than in years past, most shippers told researchers they still find value in outsourcing logistics, according to 27th Third-Party Logistics Study. NTT Data Services, Penske Logistics, and supply chain professor and researcher C. John Langley developed the report. The findings are being unveiled this week at the Council of Supply Chain Management Professionals’ EDGE conference in Nashville, Tennessee.

“Although these organizations are all dealing with unprecedented change and volatility in the global marketplace, they continue to improve and create value for their end-user customers and consumers,” Langley said. “Hopefully, this year’s study topics and results inspire further efforts to improve our supply chains via the benefits of successful 3PL-customer relationships.”

See also: The struggle continues for truck, trailer OEMs to manage fleet demand

The modern supply chain focuses on moving goods and assets as much as on transferring data and capturing information, according to the study. “The right intelligence can optimize operations, improve real-time visibility, and enable rapid decision-making,” the report authors wrote. “Technology is increasing, and 65% of shippers said that their expectations have been increasing as well. A higher number of 3PLs, 78%, believe that shipper expectations have increased in regard to the technology solutions they offer.”

Three-quarters of shippers said technology solutions play a more significant role today when selecting 3PL partners. More 3PLs (87%) said that shippers emphasize technology solutions more.

Supply chain faces a ‘talent crisis’

While the need for technology is on the rise, humans are in shorter supply. The authors called professional truck drivers and maintenance technicians “critical links in the supply chain.”

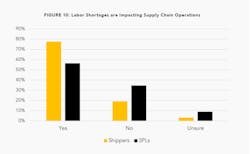

The supply chain has a “talent crisis,” according to the report. While there is a shortage of truck drivers and technicians, it's not just on the road and in the shops. Among respondents, 56% of 3PLs and 78% of shippers said labor shortages impacted their supply chain operations. More than a quarter of shippers and 3PLs believe the labor shortage is a long-term problem. On the opposite side, 22% of shipped and 13% of 3PLs believe there is no talent crisis or, if there is, it should be resolved within the year.

See also: Recruiting and retaining drivers in a post-pandemic world

The most challenging positions to fill include professional truck drivers and other equipment operators, pickers, and packers. “Those positions are also among the most difficult to retain,” the report authors wrote. They noted that 3PLs have had more success filling hourly worker jobs than shippers: 49% of 3PLs and 32% of shippers reported it takes less than a month to fill a position; 41% of 3PLs and 51% of shippers said it takes two to three months.

“Attracting and retaining talent in the supply chain remains of central importance to shippers and logistics providers,” according to Andy Moses, SVP of sales and solutions at Penske Logistics. “There are talent needs industrywide from airline pilots, ship captains, truck drivers, and warehouse workers to engineers and technology professionals. People remain central to an efficient and functional supply chain to meet society’s needs.”

Working together to strengthen value

The 2022 study investigates trends to uncover how shippers and 3PLs can work together to improve service and drive value. It also looks at growth within the 3PL industry and the development of shippers outsourcing to 3PLs. Researchers also analyzed trends and issues expected to alter the future state of logistics outsourcing.

Domestic transportation is the most frequently outsourced activity, according to the study that found 69% of shippers using 3PLs for U.S. freight—up from 67% in 2021. The most significant outsourcing shifts this past year were in freight forwarding, which increased from 44% to 60%. International transportation rose from 44% to 52%. According to the report, warehousing fell from 63% to 43%.

Shippers are also turning to 3PLs for IT solutions, particularly execution- and transaction-based technologies, such as transportation management planning and scheduling and warehouse/distribution center management.

Seven immutable laws of supply chain success

While technology improvements and offerings are making supply chains more efficient and effective, the study’s authors wrote that “there are fundamental principles governing supply chains that continue to be relevant. … A fine-tuned ability to innovate, change, and transform supply chains will be a prerequisite to achieving supply chain goals and objectives.”

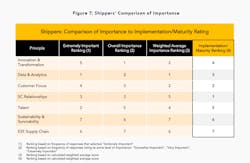

Core principles include customer focus, supply chain relationships, data and analytics, innovation and transformation, survivability and sustainability, talent, and end-to-end supply chain—or the “Seven Immutable Laws of Supply Chain Success.”

According to the report, “survivability and sustainability” and “end-to-end supply chain” were ranked the lowest among those core principles by shippers and 3PLs. Researchers said this indicates efforts and planning are in the early stages. “Complexity within the supply chain is expected to continue, and shippers and 3PLs can leverage back-to-basics principles as they build their relationships and focus on service,” the authors wrote.

Returns: The other sides of the supply chain

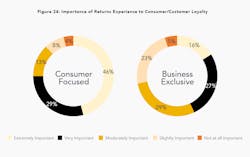

The study noted that reverse logistics has become integral to the B2B and B2C buyer experience. Often lost as the back end of the supply chain equation, 75% of consumer-focused shippers said the product return experience is essential to customer loyalty.

As buying habits continue to shift, reverse logistics represents a pivotal opportunity to boost efficiency and improve consumer satisfaction. Sixty-five percent of consumer-focused shippers and 60% of business-focused shippers reported that return expectations are growing.

ESG still in nascent stages

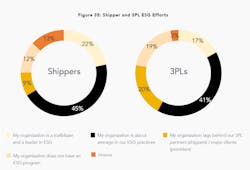

While companies’ environmental, social, and governance efforts, known in the corporate world as ESG, have increased interest across the supply chain, initiatives are still in early stages among 3PLs and shippers.

Some 22% of shippers and 17% of 3PLs rated themselves as trailblazers and leaders in ESG; 45% of shippers and 41% of 3PLs considered their organizations average in ESG practices. According to the authors, this discrepancy suggests that shippers and 3PLs may be misaligned in implementing their ESG efforts.

The report cited several ESG drivers, including consumer trends and preferences; environment and climate impacts; diversity, equity, and inclusion (DEI); and social contributions and responsibility. Regulatory mandates also drive these efforts, which the authors expect to continue.

The report can be downloaded at 3PLstudy.com

About the Author

Josh Fisher

Editor-in-Chief

Editor-in-Chief Josh Fisher has been with FleetOwner since 2017. He covers everything from modern fleet management to operational efficiency, artificial intelligence, autonomous trucking, alternative fuels and powertrains, regulations, and emerging transportation technology. Based in Maryland, he writes the Lane Shift Ahead column about the changing North American transportation landscape.