As U.S.-Mexico trade increases, Ryder expands operations around Laredo Port

With more freight moving between the U.S. and Mexico, Ryder System is growing its operations and capacity on both sides of the border. The company has opened a new logistics operation in Laredo, Texas, and expanded its drayage yard across the Rio Grande in Nuevo Laredo, Mexico.

Ryder’s growth

Ryder ranks No. 16 on the FleetOwner 500: For-Hire. The transportation and logistics company has seen major operational developments over the last year.

In April 2023, Ryder shared its plans to add 4,000 BrightDrop Zevo 600 and Zevo 400 electric vans to its lease and rental fleet through 2025. By December 2023, Ryder had secured its first RyderElectric+ customers in two South Florida fleets.

In May 2023, Ryder announced an EV fleet solution during the Advanced Clean Transportation Expo, RyderElectric+. The system aims to provide fleets with advisers, vehicle leasing, charging, telematics, and maintenance solutions.

In October 2023, Ryder entered into a definitive agreement to acquire Impact Fulfillment Services. In February 2024, Ryder had acquired Cardinal Logistics, a FleetOwner 500 Top 50 fleet. The latter acquisition would expand Ryder’s network with 200 more operating locations, 2,900 power vehicles, and 3,400 drivers.

In January 2024, Ryder also opened a 1 million-square-foot distribution center for Lexmark.

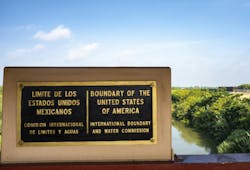

Port Laredo, located at the World Trade International Bridge in Laredo, Texas, is the top international trade port in the U.S. The transportation and logistics company’s newly built Laredo logistics operation is a 228,000-square-foot multiclient warehouse and cross dock. It is located three miles from the World Trade Bridge on the U.S.-Mexico border.

The facility has 102 dock doors and room for 143 trailers. It is within six miles of other Ryder operations in Laredo, allowing for flexibility with labor and resources.

“While we specialize in fully integrated port-to-door supply chain solutions, our new multiclient warehouse in Laredo is also a good entry point for customers looking for a logistics provider that can help them scale,” said Frank Bateman, Ryder VP of supply chain operations, in a press release. “As our customers’ needs evolve, we can seamlessly transition them into dedicated warehouses and offer a flexible mix of transportation solutions, including integrated dedicated fleets with professional drivers.”

See also: Ryder recognizes quality carriers

From internal capital expenditure approval to final construction, the process behind making the facility took about two years, Bateman told FleetOwner.

Increasing trade with Mexico

Trade between the U.S. and Mexico has grown significantly in recent years. Mexico’s economy is booming, and nearshoring trends have helped make Mexico the U.S.’s leading import partner.

See also: BrightDrop EVs expand into Mexico

Ryder began operations in Mexico in 1994. Today, Ryder Mexico manages more than 250,000 freight movements across the Mexican border each year. Ryder also operates 5 million square feet of warehouse and yard space across Mexico.

An expanded drayage yard

The project expanded its maintenance shop, growing its service stations from nine to 15.

Ryder also restructured several parts of site to add more office space, larger driver dorms, a larger cafeteria, and more parking.

The expanded parking increased the yard’s capacity by 42% for tractors and 39% for trailers. A significant portion of the expansion’s expense had to do with paving the additional parking, Bateman said.

Overall, planning and execution of the expansion took about one and a half years.

See also: Production, sale of Class 8 vehicles forecasted to rise

“A lot of it was talking to our automotive and industrial customers, trying to understand their strategy,” Bateman told FleetOwner. “What their plant volumes were going to be between the U.S., Mexico, and Canada; what trends they’re seeing; if there’s going to be some supplier shifts to Mexico, and that, in turn, would guide us as far as their needs for import/export; and how the growth is going to be in Mexico.”

About the Author

Jeremy Wolfe

Editor

Editor Jeremy Wolfe joined the FleetOwner team in February 2024. He graduated from the University of Wisconsin-Stevens Point with majors in English and Philosophy. He previously served as Editor for Endeavor Business Media's Water Group publications.