Despite widely varying media reports, the reality is the economy will continue to expand at sub-par growth rates (less than 3%) for an extended period of time as it is still in the process of reducing large imbalances that are a drag on growth.

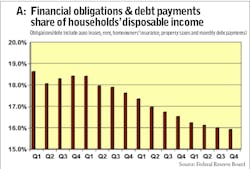

In the first quarter of this year, household wealth was 19% below its peak in the second quarter of 2007. Low interest rates are not stimulating strong growth in consumer spending since credit availability remains tight, while households are reluctant to substantially increase debt. Households have been working to reduce debt payments as a share of personal income.

Adjustments in savings and debt have been a drag on the growth rate of consumer spending during the economic recovery, but households are not likely to reverse these policies in the near future. Consumption will expand at about the growth rate of personal income. Personal income is predicted to expand at moderate rates for an extended period of time due to sluggish-to-moderate employment growth.

The real estate market—residential and private non-residential—is still in the process of reducing excess supply. The downturn in new construction activity has bottomed out, but excess supply will remain a drag on the recovery in the medium term since demand is soft due to a number of factors including tight credit conditions. Construction activity is primarily being stimulated by repairs of existing structures.

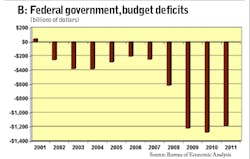

The adoption of contractionary fiscal policy, increased taxes/fees, and lower spending by state and local governments to reduce budget deficits are all a drag on growth in the medium term. Over time, the drag on economic growth from state and local government spending will decrease as budget deficits trend downward. While state and local spending will become less of a drag on economic growth in the coming years, federal government spending will become a bigger drag since the budget deficit is at unsustainable levels, requiring the adoption of contractionary fiscal policy.

The U.S. economy is in the process of reducing imbalances that are a drag on growth, but it is also undergoing changes that are improving the economy’s competitiveness that will accelerate growth in the future. These factors include lower inflation in the U.S. as compared to competitors, sluggish wage growth combined with productivity gains, and the depreciation of the exchange rate of the U.S. dollar. The acceleration in economic growth from a more competitive U.S. economy will be gradual over time.

In conclusion, monthly economic statistics will be mixed for an extended period of time as the U.S. economy is still in the process of reducing imbalances that are a drag on growth, and the media will provide bipolar headlines of growth depending upon a single economic statistic.

For planning and strategic purposes, carriers should assume sluggish-to-moderate freight growth for an extended period of time.

Commercial Motor Vehicle Consulting publishes the monthly newsletter “Visibility of the Supply Chain” for general freight carriers. To order a copy, contact Chris Brady of CMVC at cmvc1@ verizon.net or 516-869-5954.

About the Author

Chris Brady

Founder of Commercial Motor Vehicle Consulting and former FleetOwner contributor.