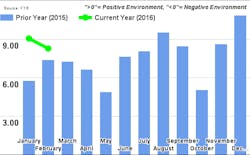

The most recent Trucking Conditions Index (TCI) metric compiled by research firm FTR showed “continued softening” in February due to a weaker freight environment for trucking, with the current reading of 8.27 reflects FTR’s forecast for a slowdown in truck loadings from an average of 4% to 2% for full year 2016.

Yet the company noted there are still “positive indicators” for trucking including, adding that it expects its TCI to begin a steady rise into 2017 and 2018 due to expected regulatory capacity constraints, though the risk of recession or the possibility of temporary spikes in fuel prices could change things in the 2018 timeframe.

“The market has certainly softened in 2016, yet there are still enough positive indicators to keep the freight markets afloat despite the weakness,” noted Jonathan Starks, FTR’s COO, in a statement.“Freight loads are looking to slow this year, but 2% growth is still a reasonable environment for truck operations,” he said. “What it doesn’t do is create pressure on capacity, which is what would be needed to improve the rate environment. A key focus will be whether the manufacturing sector can stabilize and begin to grow again. I believe it will, but it may still be a quarter or two before fleets start to benefit from that activity.”

Starks noted that the freight rate environment has deteriorated, but unless the market sinks further, trucking should expect to see contract rates begin improving in the second half of the year.

“Spot rates have been on a steady decline, but have recently turned back up and should show year-over-year increases sometime this summer,” he pointed out.

“The wildcard right now will be how fuel prices behave,” Starks emphasized. “If prices rise quickly, it could have a big impact on cash flow, especially for the smaller carriers. If that happens we would expect to see a jump in fleet bankruptcies, something that has remained at historic lows over the last year despite the headwinds that the industry has been facing.”

About the Author

Fleet Owner Staff

Our Editorial Team

Kevin Jones, Editorial Director, Commercial Vehicle Group

Cristina Commendatore, Executive Editor

Scott Achelpohl, Managing Editor

Josh Fisher, Senior Editor

Catharine Conway, Digital Editor

Eric Van Egeren, Art Director