Fleet survey shows uncertainty and hope in trucking this year

There is a lot of uncertainty in trucking recruitment and retention as 2018 gets into full swing, according to a Driver iQ survey of large and small truckload carrier recruiters in the U.S. But with that uncertainty comes some hope.

While driver turnover was on the rise in 2017, those surveyed do not expect to get anywhere near as bad as it did earlier this decade or its peak of 2006.

Among the uncertainty facing the industry this year is driver applicant expectations — with the sector nearly split on expecting more or fewer than in 2017. While most fleets in the survey said they had unseated trucks in the final months of 2017, most said they plan to add more tractors in 2018, which could point to the hope for a busy year in trucking.

Below are some highlights from the Driver iQ survey, which is based on the last quarter of 2017 and looks into the first quarter of 2018. The study included 23 of the 25 top truckload carriers in the industry, which are Driver iQ customers.

Recent Turnover: Over the last three quarters, driver turnover has risen from 71% to 90% — a 27% increase for large truckload carriers. It is still nowhere near the record number of 140% in 2006. The last time turnover broke 100% was in 2014.

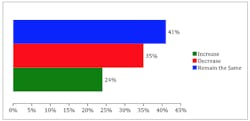

Expectations of future driver turnover: Slightly more than 40% of the carriers expect that driver turnover will remain the same over the first of 2018 quarter — compared with 25% that think it will increase.

Expectations of future applications: There is no consensus about prospective applicants. About 40% of recruiters are expecting applicants to increase in the first quarter of 2018 — while another 40% expect them to decrease.

Age of drivers hired: While the industry cannot agree on the number of applicants it has received, it does recognize that the average age of drivers has not changed in the last six months.

Expectations of future compensation: Almost 60% of the driver recruiters expect that compensation (pay and benefits) will increase in the first quarter of 2018 compared to last quarter of 2017. No one expected it would decrease. As indicated earlier, most expect that driver turnover will remain the same. With increases in pay, the surveyors assume that driver turnover may stabilize.

Sign-on bonuses: While 60% of carriers who responded to the survey expect compensation to rise, just slightly more than 50% are offering sign-on bonuses.

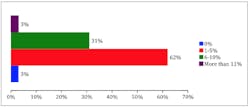

Unseated trucks: More than 90% of fleets surveyed had unseated trucks in the last quarter of 2017. The majority (62%) had 1%-5% of trucks unseated; another 31% saw 6%-10% unseated.

Expectations of adding more capacity: Even though almost all of the industry is experiencing unseated trucks, more than 90% expect to add more tractors (increase capacity) in the first quarter of 2018 — with 60% expecting to add less than 5%. No carrier expects to increase capacity more than 15%.

Younger drivers: The industry is somewhat split on the support of drivers younger than 21 being able to operate in interstate commerce if they trained through an apprentice-type program. Even those who support the concept of training young drivers in apprentice-type programs are split on actually hiring drivers between 18-21 — just 52% said they would.

Tracking the cost of driver retention: The cost of driver turnover includes not only the cost of recruiting — entry administration, fixed asset costs due to idle equipment, and profit loss due to idle equipment — but also the cost of retention such as pay increases, training, seniority benefits and recognition awards. In the last quarter of 2017, 69% of respondents tracked the cost of driver retention.

The best source with best retention rate: While drivers come from many different referral sources (job fairs, advertising, job boards, rehires, training schools, referrals, etc.), by far the greatest source for finding and retaining driver is from referrals.

Driver iQ, provides background screening and driver monitoring services to the trucking industry. It also maintains an up-to-date driver employment database. Carrier customers are granted access to employment verification, driving records, criminal record searches, and ongoing driver monitoring.

About the Author

Fleet Owner Staff

Our Editorial Team

Kevin Jones, Editorial Director, Commercial Vehicle Group

Cristina Commendatore, Executive Editor

Scott Achelpohl, Managing Editor

Josh Fisher, Senior Editor

Catharine Conway, Digital Editor

Eric Van Egeren, Art Director