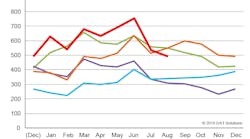

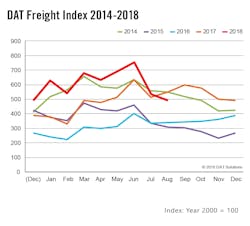

Spot market freight availability dropped for the second straight month in August due mostly to a decline in shipper demand for flatbed equipment, according to the DAT North American Freight Index, a monthly indicator of transportation trends.

A seasonal lull in searches for available dry van trailers, the most common equipment type on the spot truckload market, also contributed to the late-summer slump.

Refrigerated (“reefer”) volume rose to near-peak levels, however.

“August was the strongest month this year for the number of loads that moved on the spot market, according to the DAT RateView database,” DAT pricing analyst Mark Montague said. "However, the volume of loads posted to the DAT load board marketplace actually decreased because 3PLs and freight brokers were able to find trucks more efficiently.”

The year-over-year decline in load posting activity is likely to persist through September. Spot market demand in September 2017 was inflated by massive supply chain disruptions caused by Hurricanes Harvey and Irma.

A strong holiday freight season this year should again boost spot market demand compared to 2017 levels.

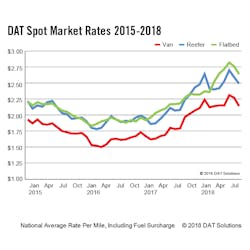

National average spot market rates in August slipped a few cents lower compared to July but remained 20% above August 2017 averages for all equipment types.

The average van rate fell 13 cents to $2.14 per mile due to an increase in available capacity, while the flatbed rate slid 12 cents to $2.64 per mile on declining energy and construction activity. The rate for reefer equipment dropped 10 cents to $2.49 per mile in August, as produce harvests entered a seasonal transition.

The average spot van rate was 35 cents per mile higher year over year. The flatbed rate was up 46 cents, and reefers were 41 cents higher.

Established in 1978, DAT operates a network of load boards serving intermediaries and carriers across North America. For more than a decade DAT has published its Freight Index, which is representative of the dynamic spot market.