Class 8 orders defy trends with surprisingly strong start to 2026

Key takeaways

- Defying the slump: January Class 8 orders topped 30,000 units for the second straight month, significantly outpacing the 10-year monthly average.

- Back-to-back growth: For the first time since early 2024, the market has seen two consecutive months of year-over-year order growth.

- Strategic buying: Analysts attribute the strength to fleets positioning themselves ahead of EPA27 regulations and capitalizing on clearer tariff visibility.

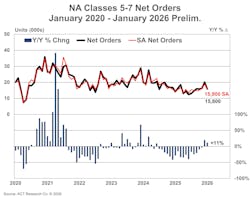

- Medium-duty cools: Unlike the heavy-duty sector, Class 5-7 orders dipped 10% month-over-month, returning to more typical seasonal patterns.

If you’re looking for another sign that today’s trucking and freight markets are outside typical cycles, North American fleets started the new year in a buying mood, placing more Class 8 vehicle orders than the 10-year average, according to research firms that follow the commercial vehicle markets.

January Class 8 tractor orders marked the first time since 2024 that OEMs saw back-to-back monthly year-over-year order growth, according to FTR Transportation Intelligence.

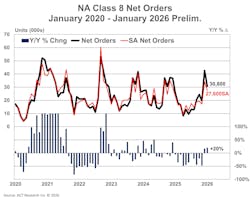

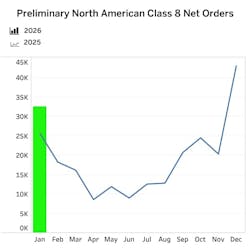

Surprisingly strong start: Preliminary data from FTR shows Class 8 orders reached 32,500 units in January. ACT Research’s preliminary data pins the order board at around 30,800 units. While both totals are down from the heavy-duty truck and tractor order surge in December, they outpaced FTR’s 10-year January average of 26,300.

FTR’s January figures are down 24% from December but up 27% compared to the first month of 2025. ACT’s year-over-year figures were up 20% when comparing this January to 2025. The last time the Class 8 market saw back-to-back year-over-year monthly growth was April and May 2024, according to FTR.

The ’27 prebuy shadow: While the over-the-road freight market remains sluggish, analysts believe the recent surge in orders is more strategic, as carriers seek to get ahead of rising costs and regulations.

What the analysts think: “After a weak October and November, a few things have happened that, in our thinking, have helped spur recent order activity,” Carter Vieth, ACT Research analyst, said February 3. “The U.S. economy continues to outperform expectations, clarity surrounding EPA27 bolstered demand, and arguably most importantly, since the end of November, we’ve seen a sustained run-up in spot rates after three successive Midwest snowstorms.”

- Spot rates: After snow blanketed dozens of states in late January, FTR saw broker-posted spot rates experience their most significant jump since 2023. While dry van spot rates rose 20 cents, reefer’s 45-cent surge on the Truckstop.com broker board is the largest on records dating back to 2008. Flatbed rates have risen in 10 of the past 11 weeks.

- EPA27: The Environmental Protection Agency (EPA) is expected to propose revisions to the 2027 NOx rule this spring that would retain the January 2027 implementation date and the reduced greenhouse gas emissions standard, while eliminating costly extended warranty requirements and modifying other compliance provisions.

- U.S. economy: While U.S. consumer confidence has tumbled to decade-long lows at the start of 2026, higher-income earners’ spending has helped the U.S. economy outperform expectations.

Yes, but what about fleet profits? “Some stabilization and improvement in the freight market since late 2025 also may have provided modest support at the margin, but fleet profitability and capital discipline remain binding constraints,” noted Dan Moyer, FTR senior commercial vehicle analyst, on February 3. “Purchasing behavior continues to be replacement-driven with only modest early EPA 2027 influence.”

Fleets haven’t operated equipment this old in over a decade: The year began with more fleets operating older equipment as the freight recession entered its fourth year. The average Class 8 vehicle is 6.3 years old, a figure that hasn’t been topped since 2013, according to ACT.

While some aging fleets are sharpening their replacement focus for 2026, the commercial vehicle market isn’t out of this downcycle yet.

Fleets still face more risks in 2026: “Lingering downside risks include fragile freight fundamentals, elevated cost pressures, geopolitical uncertainty, and broader macroeconomic risk,” FTR’s Moyer notes. “These risks temper at least some of the enthusiasm around the recent improvement in orders.”

He added that a “durable recovery” needs more than two months of year-over-year order growth. To sustain the recent growth, Moyer said the industry also needs “meaningful improvement in freight demand, freight pricing, and overall economic conditions” through 2026.

Fleets still behind on 2026 order season: To back this up, FTR noted that despite January’s gain, cumulative orders for the 2026 season (September through January) are down 13% year over year. This underscores the notion that recent strength reflects the execution of deferred replacement demand rather than a true demand inflection, according to Moyer.

Market monitor notes

- Vocational vs. highway: On-highway markets made up the bulk of the December-to-January order decline, according to FTR. But both the on-highway and vocational markets contributed significantly to the year-over-year increase in orders.

- Policy clarity: More than a year into the second Trump administration, tariff-adjusted pricing is clearer, and regulatory visibility has improved, which FTR believes likely encouraged fleets to move forward with purchases that had been delayed through much of the fall, shifting order activity into late 2025 and early 2026 rather than creating incremental demand.

- What about medium-duty markets? ACT’s Vieth on the medium-duty commercial vehicle market (Class 5 to 7): “Medium-duty preliminary orders in January totaled 15,800 units, up 11% year over year. Given last January was the weakest January for orders since 2013, the 11% improvement seems to be more of an easy comp than meaningful improvement.”

- Disclaimer: Both research firms expect to finalize these preliminary figures by mid-month.

About the Author

Josh Fisher

Editor-in-Chief

Editor-in-Chief Josh Fisher has been with FleetOwner since 2017. He covers everything from modern fleet management to operational efficiency, artificial intelligence, autonomous trucking, alternative fuels and powertrains, regulations, and emerging transportation technology. Based in Maryland, he writes the Lane Shift Ahead column about the changing North American transportation landscape.