If 2024 was defined by "holding the line," 2025 was the year of the “freight recovery that never happened.” The commercial vehicle landscape spent much of last year in a state of strategic stalemate, balancing the promise of AI-driven safety and autonomous roadmaps against the immediate, crushing weight of equipment tariffs and a stubborn capacity glut.

In our annual year-end review, we dive into the headlines that dominated the FleetOwner newsroom in 2025 and drew the most clicks and responses from you, our valued readers and fleet leaders. From the localized success of biodiesel in the Heartland to the global trade policies that hit every fleet’s bottom line, these stories represent the challenges we’ve overcome—and the road map for what comes next.

The following links and recaps offer a deep dive into the dualities of 2025. You’ll find reporting on the "survival economy" and the labor shifts defining the next generation of drivers, alongside technical deep dives into the AI-driven safety tools that are no longer "futuristic" but foundational. We also used 2025 to help fleet leaders assess their current and future hiring needs, from encouraging more women to join and grow in the industry to attracting more Generation Z to pursue trucking as a viable career path.

Whether you are navigating the complexities of the national truck parking crisis or setting your sights on a 2030 zero-emission roadmap, this compilation serves as both a reflection of where we’ve been and a guide for where we’re going.

Here are the top FleetOwner stories of 2025:

10. What’s your 2030 road map?

No matter who is president this year or in five years, trucking will be different. As more zero-emission technologies mature, autonomous trucking solutions are nearing reality. As President Trump returns to the White House, determined to end EV incentives and provoke our North American neighbors into a trade war, the outlook may appear unclear. However, a good place to look is where manufacturers focus their money and efforts.

Even though tariffs could make fleet equipment more expensive and shift supply chains internally, the U.S. still needs trucks more than anything else to fuel the economy. However, the business models around how trucks are sold, operated, and powered will continue to evolve during the second half of the 2020s. So, one thing is clear: Things are changing, and it’s important to look beyond the next turn and into the future for your fleet’s success. Read more…

9. Why the U.S. truck parking shortage is so complicated

There is one parking space for every 11 drivers on the road, noted Doug Marcello, trucking and commercial transportation attorney with the law firm Saxton & Stump. “[When] you couple that with the hours-of-service requirement, that drivers can only drive 11 hours, be on duty 14 hours, it increases not just a demand but a timing for that demand, resulting in a number of them having to park on exit ramp sides of roadways, etc.”

The lack of truck parking is not only problematic but also complicated. Read more…

8. How Iowa brought biodiesel to the mainstream

Iowa is the place to buy biodiesel fuel. Biodiesel sales in the state doubled from 2023 to 2024. Pilot Travel Centers also recently launched a B99 biodiesel pump for fleet usage at one of its Des Moines travel centers. These statistics highlight a demand for more sustainable fuel options among fleets and consumers alike.

Grant Kimberley, executive director of the Iowa Biodiesel Board, attributes the increase in biodiesel sales and the addition of the new pump to the state's local policies and incentives to get the fuel into the mainstream. After all, Iowa is the nation’s leading biodiesel producer, and any increase in sales is a bump for the state’s local economy.

But could Iowa’s success in normalizing biodiesel consumption spread across the country? Read more…

7. Improving routes with data deluge

Fleet operations today generate and consume incomprehensible volumes of data daily. Real-time data from trucks, tractors, trailers, and drivers can overwhelm even the most tech-savvy carriers. But knowing which data points matter most can vastly improve routing efficiency.

“This industry has drowned in data for decades,” Brian Antonellis, SVP of fleet operations at Fleet Advantage, told FleetOwner. “But, truly told, it piles up in the system.”

A typical telematics system will send up to 30 data points every five seconds to five minutes. That data still has great potential for routing. Though the fire hose of information may feel overwhelming, fleets can always start on the lower rungs of an optimization ladder and work their way up. Read more…

6. How Trump’s cabotage crackdowns impact Hispanic drivers

Countless news headlines say the Trump administration is taking a hard stance on border issues, particularly with Hispanic laborers. But how is this affecting the trucking industry?

President Donald Trump is pursuing two major crackdowns on fleets’ operations this year: greater enforcement of cabotage laws and renewed English proficiency requirements. The crackdowns have an outsized effect on Spanish-speaking drivers, such as those crossing into the U.S. from Mexico with B-1 visas or domestic drivers who are U.S. citizens.

Executives of some major public trucking companies, including Schneider and J.B. Hunt, suggested that stricter enforcement of laws like cabotage and English requirements could resolve overcapacity and improve pricing dynamics for fleets. Read more…

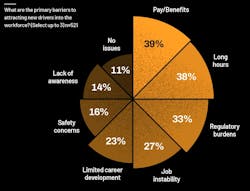

5. How to hire and hold on to Gen Z

Labor challenges are nothing new to the trucking industry. Driver and technician shortages get the most attention, but a new workforce shortage is brewing.

The baby boomers, who have dominated trucking for decades, are leaving the industry. But Gen Z isn't replacing them, creating a next-generation shortage. The good news is there are opportunities for fleets to attract the youngest labor pool, according to Melanie Rittenour, director of human resources for Keller Trucking.

“If you look at the studies, we're already in a labor shortage across the country in any industry, but they're already predicting some significant labor shortages in the truck driver market,” Rittenour told FleetOwner. “It's not one that's going to be as easily accommodated by artificial intelligence, so we are going to need the individuals fulfilling these roles. I think that's why it's going to be really important that we make sure we address the needs of the next generation so that we can keep the trucks full and keep freight delivered.” Read more…

4. Not enough drivers or too many?

Excess capacity has helped weaken carriers’ pricing power for years. Despite this hostile environment, the CDL population is growing: the American Transportation Research Institute estimates that there are about 3 million long-haul CDL holders today, up 30% from 2016’s estimate of 2.3 million.

While the driver shortage has remained one of the top fleet concerns for several years, not everyone agrees that there is a labor shortage in trucking. In a recent Stifel webinar, analysts with Transportation and Logistics Advisors argued that the market is plagued with too many drivers.

On the other hand, a recent Tech.co survey argued that carriers don’t have enough qualified drivers. So who’s right? Read more…

3. How to foster women’s growth in the industry

Women make up 50% of the population and—as is evident on the following pages—have proved to be a vital part of the trucking and transportation industries.

“Whether they’re in operations, safety, recruiting, management, maintenance, or behind the wheel, women are an integral part of trucking and are driving our industry forward,” Sarah Rajtik, American Trucking Associations’ COO, told FleetOwner.

As Trimble’s lead data scientist, Tawni Marrs, pointed out to FleetOwner: Studies show that diversity and inclusion are linked to workplace innovation; therefore, having women and other diverse perspectives in the industry “drives that innovative front.”

Not only should the industry foster women’s growth, but it should also focus on attracting the next generation of leaders. And while the industry has a long way to go in fully supporting women and ensuring their growth, it is ripe for capable women leaders to rise to the top. Here are some tips to help foster women’s growth in transportation. Read more…

2. AI and automation drive the next era of commercial vehicle safety

Fleet safety’s digital evolution is driving a powerful transformation in transportation. It was hard to find any trucking technology solution provider in 2025 that didn’t incorporate artificial intelligence into its products. While these improved technologies promise to make roads safer, the pace of change can be overwhelming. For safety-focused managers, the emerging challenge is determining which tools are best suited for your operations and preparing for the future of fleet safety.

To address these contemporary challenges, FleetOwner reached out to several leading transportation technology providers to identify which solutions fleets are underutilizing and to forecast where commercial vehicle fleet safety is headed in the second half of this decade.

The most powerful safety solutions aren’t just about installing more devices inside and outside the cab; it’s about connecting every aspect of fleet operations—from the vehicle’s maintenance records to in-cab coaching—to build an intelligent ecosystem. Read more…

1. Tariffs dominate trucking’s sluggish 2025 economy

This past year was widely forecast as the year when the freight recession would finally end. Instead, the industry spent 2025 in a defensive posture as President Donald Trump went on a trade-war offensive. From the first threats in January to the formalized 25% duties on medium- and heavy-duty trucks that took effect on November 1, the Trump administration’s trade policy became the single greatest variable for fleet survival.

The impacts weren’t just limited to the price of a new tractor—though those rose by as much as $35,000 for some models. The "tariff roller coaster" hit every line item: Tires saw double-digit price hikes, steel and aluminum duties doubled to 50% for trailer manufacturing, and even the simple cost of maintenance parts became a moving target.

Beyond the equipment, the psychological toll of "self-inflicted uncertainty" caused major carriers such as J.B. Hunt and Knight-Swift to slash capital spending and pause growth plans. As we enter 2026, the question for fleets is no longer if tariffs will impact them, but how to navigate a global supply chain that has been fundamentally redrawn. With the USMCA looming for review and global retaliatory duties still in flux, the only certainty is that the "old normal" of trade is gone. Read more about how tariffs impacted trucking and transportation in 2025…

In addition to these articles, FleetOwner publishes several popular annual features that attract attention across the trucking and transportation industries. These include our annual looks at the largest commercial transportation systems in the U.S., the FleetOwner 500: For-Hire and FleetOwner 500: Private Fleets.

Our annual profiles of women in the industry, Women in Transportation 2025, were published this spring. Each year, FleetOwner recognizes the transportation operations of private fleets with the FleetOwner Private Fleet of the Year award. This fall, we expanded and rebranded our annual New Models into the 2025 FleetOwner vehicle guide, our largest-ever look at the next generation of heavy-duty, medium-duty, light-duty, and alternative-powered trucks and vans.

We wrapped up the year with the 2025 Trucking By the Numbers feature, an infographic highlighting the facts and figures shaping the trucking and transportation industries.

To view what's ahead for FleetOwner in the new year, please check out our 2026 Media Kit.

About the Author

Josh Fisher

Editor-in-Chief

Editor-in-Chief Josh Fisher has been with FleetOwner since 2017. He covers everything from modern fleet management to operational efficiency, artificial intelligence, autonomous trucking, alternative fuels and powertrains, regulations, and emerging transportation technology. Based in Maryland, he writes the Lane Shift Ahead column about the changing North American transportation landscape.